wwwsimf.ru

Prices

What Steps To Take To Refinance Your Home

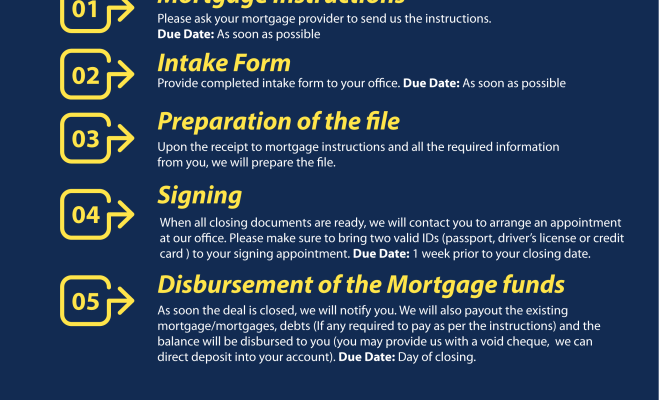

Refinancing simply means replacing your existing mortgage loan with another one that has a different rate and term. You pay off your current mortgage with the. How to Refinance Your Home · Make sure you own a home. · Get a rough idea what your home is worth. · Call one of First Foundation's Mortgage Brokers · We'll answer. Step 1: Gather all your information for the application · Step 2: Apply to refinance your mortgage · Step 3: Work with us through the refinancing process · Step 4. Consider filing your application about two months before you want to close on your refinance. This will allow you to get financing in order and may help. Mortgage refinancing is the process of replacing your current home loan with a new one, often with different terms. Homeowners typically refinance to secure. And how is your credit? The answers will determine what kind of loan you can qualify for and whether or not you'll need to get mortgage insurance. Do you have. Streamline refinances often have less paperwork and an easier application process compared to Conventional refinances. If you are a current Freedom Mortgage. How To Refinance My Mortgage · Determine your financial goals · Check your credit score · Find a lender and a rate that fits your goals · Choose the right refinance. Before you can refinance your mortgage, you'll need to get pre-approved to understand what types of loans and interest rates are available to you. We'll review. Refinancing simply means replacing your existing mortgage loan with another one that has a different rate and term. You pay off your current mortgage with the. How to Refinance Your Home · Make sure you own a home. · Get a rough idea what your home is worth. · Call one of First Foundation's Mortgage Brokers · We'll answer. Step 1: Gather all your information for the application · Step 2: Apply to refinance your mortgage · Step 3: Work with us through the refinancing process · Step 4. Consider filing your application about two months before you want to close on your refinance. This will allow you to get financing in order and may help. Mortgage refinancing is the process of replacing your current home loan with a new one, often with different terms. Homeowners typically refinance to secure. And how is your credit? The answers will determine what kind of loan you can qualify for and whether or not you'll need to get mortgage insurance. Do you have. Streamline refinances often have less paperwork and an easier application process compared to Conventional refinances. If you are a current Freedom Mortgage. How To Refinance My Mortgage · Determine your financial goals · Check your credit score · Find a lender and a rate that fits your goals · Choose the right refinance. Before you can refinance your mortgage, you'll need to get pre-approved to understand what types of loans and interest rates are available to you. We'll review.

Contact your mortgage lender for more information on the best refinance options for your specific needs. You can choose the lender you already worked with for. The Preferred Rewards program is our way of rewarding you for what you already do. Preferred Rewards members may qualify for an origination fee or interest rate. The mortgage refinancing process · Step 1: Gather all your information for the application · Step 2: Apply to refinance your mortgage · Step 3: Work with us. Does not impact your credit score. Get approved for a mortgage refinance in 60 Seconds. Instant online approval 24 hours to process the paperwork. Lowest. When you refinance, you get a new mortgage and that loan amount is used to pay off the balance of the old mortgage. If you have sufficient equity in your home. Steps to Refinance Your Mortgage · Determine if refinancing makes financial sense for you. · Shop around for the best rates and compare lenders. · Apply to. After figuring out the minimal requirements for this new mortgage, the next step is to identify how much money you will need. The amount of equity you have. When you're approved for mortgage refinancing, the old loan is paid off, and you will make payments to the new one going forward. The mortgage refinancing. If you refinance with your existing lender, you may get a break on mortgage taxes, depending on your state's laws. “That's a carrot that they dangle,” says. Did you purchase your home with an adjustable rate mortgage but now prefer a fixed rate? Do you want to lower the total amount of interest you'll pay on your. Steps to Refinance Your Mortgage · Determine if refinancing makes financial sense for you. · Shop around for the best rates and compare lenders. · Apply to. How do you refinance a house? · Determine your home equity amount. You can calculate your home equity by subtracting your mortgage balance from your home's value. You are trying to get a new mortgage on your property for one reason or the other. In the process of getting a new mortgage the old mortgage is. What is refinancing a home? · 1. Shop around. Refinancing a mortgage starts with shopping around for loan offers. · 2. Apply. To apply for a mortgage refinance. What Is the Refinancing Process? · 1. Make Sure Refinancing Will Benefit You · 2. Contact a Lender · 3. Fill out Your Application · 4. Sign Your Disclosures · 5. “The general rule is to consider refinancing when you see interest rates 1% lower than what you currently pay,” says Rashalon Hayes, assistant vice president of. Home loan refinancing is an easy process, especially if you refinance with your current lender. However, it always makes sense to shop for the best (lowest). Refinancing is a great option for converting equity into much-needed funds. It is a secure loan with a lower interest rate compared to other personal loans. When you apply for your loan, you'll be able to upload key documents to verify your income, assets, debts and other information. Having these documents on hand. Determine the basic goals you want to achieve by refinancing. · Determine how long you plan on holding the loan. · Does it make sense to take a higher interest.

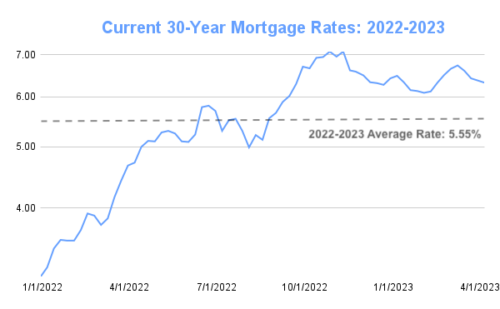

What Is The 30 Year Mortgage Interest Rate

The typical rate on a year fixed loan is just north of 6%, with some lenders offering rates in the high 5% range for the most qualified borrowers. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. A year fixed-rate mortgage is a home loan with a repayment term of 30 years and an interest rate that remains the same throughout the life of the loan. For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. On Monday, September 16, , the current average interest rate for the benchmark year fixed mortgage is %, decreasing 6 basis points over the last week. year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. On a $, mortgage, you would. year fixed rate:APR %. +%. Today. %. Over 1y. year fixed rate You'll have to complete a loan application to see mortgage interest rates. The typical rate on a year fixed loan is just north of 6%, with some lenders offering rates in the high 5% range for the most qualified borrowers. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. A year fixed-rate mortgage is a home loan with a repayment term of 30 years and an interest rate that remains the same throughout the life of the loan. For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. On Monday, September 16, , the current average interest rate for the benchmark year fixed mortgage is %, decreasing 6 basis points over the last week. year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. On a $, mortgage, you would. year fixed rate:APR %. +%. Today. %. Over 1y. year fixed rate You'll have to complete a loan application to see mortgage interest rates.

Year Fixed-Rate Jumbo · Interest% · APR%.

In the same period last year, the rate on a year benchmark mortgage was %. “Mortgage rates have fallen more than half a percent over the last six weeks. With these mortgages, your interest rate won't change over the life of the loan. So if you lock in a rate of %, which was the average year fixed mortgage. See the average year mortgage rate for the last 10 years. year national mortgage rates have hovered between % and % since Fixed year mortgage rates in the United States averaged percent in the week ending September 6 of This page provides the latest reported value. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Mortgage rates are the rate of interest that is charged on a mortgage. LOAN TYPE. 15 year Fixed. RATE. XXX. APR Footnote(Opens Overlay). XXX. LOAN TYPE. As of Sept. 13, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 15 pm EST. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. Simple Mortgage Calculator. Mortgage Amount. $. Interest Rate. %. Mortgage Term (years). 15, 20, 25, 30, Total Interest. $, Total Cost. $, National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 2 basis points from % to % on Saturday. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. 8/30/, %. +%. +%, %. +%. +%. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. What is a year fixed-rate mortgage? A year fixed-rate mortgage is a home loan repaid over 30 years with an interest rate that does not change. The year fixed mortgage rates for September 15, ; year fixed VA ; year fixed VA, %, %. Learn About Year Fixed Loans. Year Fixed. Rate%. /. APR%. Points. (). What A mortgage rate lock keeps your interest rate from changing for a period of. A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the.

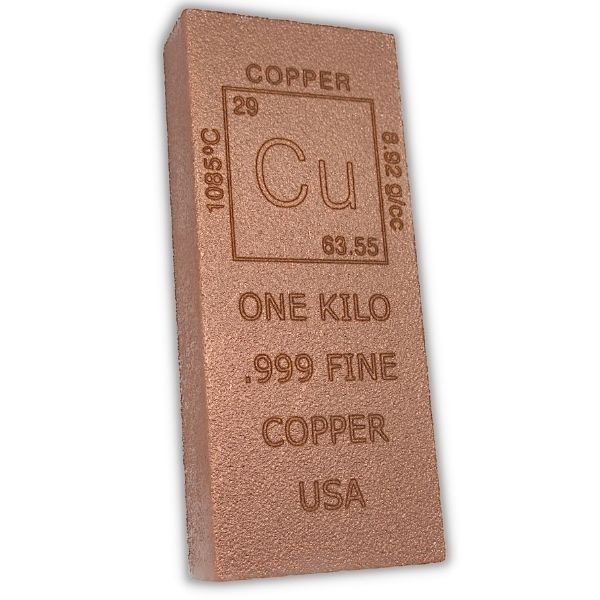

Robert Kiyosaki Buying Gold And Silver

Guide to Investing in Gold and Silver Audiobook By Michael Maloney, Robert Kiyosaki - foreword ABC's of Buying a Rental Property Audiobook By Ken McElroy. Robert Kiyosaki: Invest in Gold, Silver and Bitcoin — Here's Why New Post: Robert Kiyosaki Advises Buying Bitcoin Today — Foresees a Rush to. buying gold, including gold bullion, gold coins, and gold jewelry In the words of Nomad Capitalist Event speaker Robert Kiyosaki, Gold and Silver are God's. SchiffGold is precious metals dealer specializing in gold and silver bullion. We offer the highest overall value based on price, integrity and experience. Robert Kiyosaki's silver coin scheme - The insane investment idea that the world's best selling finance author just can't stop bragging about. Author Robert Kiyosaki expects the US dollar to become worthless soon. Many central banks, including the Fed, are printing more and more money to create the. America goes a trillion $ in debt every days. Now do you know why you must buy gold, silver, and Bitcoin? On which platforms or institutions can one buy silver or gold in South Africa? 4 yrs. Cameron Hunter. Walter Ebdon Robert Kiyosaki is very. Robert Kiyosaki telling people to buy gold, silver and BITCOIN! · Gold:silver price ratio is at historical levels(). · Silver is a. Guide to Investing in Gold and Silver Audiobook By Michael Maloney, Robert Kiyosaki - foreword ABC's of Buying a Rental Property Audiobook By Ken McElroy. Robert Kiyosaki: Invest in Gold, Silver and Bitcoin — Here's Why New Post: Robert Kiyosaki Advises Buying Bitcoin Today — Foresees a Rush to. buying gold, including gold bullion, gold coins, and gold jewelry In the words of Nomad Capitalist Event speaker Robert Kiyosaki, Gold and Silver are God's. SchiffGold is precious metals dealer specializing in gold and silver bullion. We offer the highest overall value based on price, integrity and experience. Robert Kiyosaki's silver coin scheme - The insane investment idea that the world's best selling finance author just can't stop bragging about. Author Robert Kiyosaki expects the US dollar to become worthless soon. Many central banks, including the Fed, are printing more and more money to create the. America goes a trillion $ in debt every days. Now do you know why you must buy gold, silver, and Bitcoin? On which platforms or institutions can one buy silver or gold in South Africa? 4 yrs. Cameron Hunter. Walter Ebdon Robert Kiyosaki is very. Robert Kiyosaki telling people to buy gold, silver and BITCOIN! · Gold:silver price ratio is at historical levels(). · Silver is a.

But I always thought, “This was good, because I could take on better positions.” So today, I don't know the hardest thing is storing all the silver and gold I. When Kiyosaki was asked if he was adding anything to his portfolio, his response was simple: “I'm buying more gold and silver.” Kiyosaki sees a glorious. And I've had the life experience of being in the gold and silver markets. I've taken a gold company public and a silver company public back in the '90s, and. Gold and silver are “global” money because they cannot be printed, are scarce, and are universally recognized for their value, according to Robert Kiyosaki. Guide to Investing in Gold and Silver Audiobook By Michael Maloney, Robert Kiyosaki - foreword ABC's of Buying a Rental Property Audiobook By Ken McElroy. buying gold, including gold bullion, gold coins, and gold jewelry In the words of Nomad Capitalist Event speaker Robert Kiyosaki, Gold and Silver are God's. Rich Dad Poor Dad author Robert Kiyosaki is warning Americans of a major crash "Major crash to come buying more gold, silver now, waiting. If you are not into Bitcoin I suggest buying silver coins, preferably US silver eagles. Please start acquiring gold, silver, Bitcoin, if you. Buy Gold & Silver · News & Articles If you pay attention to financial media you've probably heard of “Rich Dad, Poor Dad.” The author, Robert Kiyosaki. You are right, gold would need to be converted back to "real" money not "cash" to purchase real estate. The reason for Robert Kiyosaki's statement "cash IS. Rich Dad Poor Dad author Robert Kiyosaki says now may be the last chance to buy gold and silver at low prices. America goes a trillion $ in debt every days. Now do you know why you must buy gold, silver, and Bitcoin? Gold isn't just a metal; it's a fortress for your wealth. Join the ranks of smart investors like General Flynn and Robert Kiyosaki who have harnessed the. Live Pricing for Gold and Silver Coins and Bullion. Buy select pre U.S. gold coins in Mint State grades at low prices with excellent service. I just kept saving it because I don't trust it to help. So everybody can buy a silver coin today for 20 bucks. Silver Eagles. But how many people will go to a. Ready to Buy or Sell? A precious metals expert will walk you through the process. Request an Expert. Questions? Schedule a return phone call from a Precious. Robert has taken cash, and with it, he bought gold, silver, and bitcoin. He also claimed that if he's going to buy something, he's going to use debt. This is. Robert Kiyosaki is a financial educator, author, and businessman who believes in investing in assets that have the potential to hold value. wwwsimf.ru: Guide to Investing in Gold and Silver: Protect Your Financial Future (Audible Audio Edition): Michael Maloney, Robert Kiyosaki - foreword. Our friend Robert Kiyosaki of Rich Dad, Poor Dad fame, holds up a gold coin in one hand and a dollar in the other. “This is real,” he says about the money.

Investing In Mortgage Bonds

An MBS is an asset-backed security that is traded on the secondary market, and that enables investors to profit from the mortgage business without the need to. Mortgage-backed securities (MBS) are fixed-income securities that utilize mortgage loans as collateral and the source of funds for payments on the security. Investing in mortgage-backed securities requires investors to understand how their bond's performance will change with varying prepayment activity. It is. A significant widening of spreads in the agency mortgage-backed securities market, creating a potentially attractive opportunity for investors. Agency mortgage-backed securities (MBS) play an important role in Agency MBS have outperformed US Treasury bonds over longer investment horizons. Designed to deliver total return through investing in a diversified portfolio of mortgage-backed securities. Mortgage-backed securities, or MBS, are investments that take mortgages, pool them, and then sell the pools of loans to investors as a single investment. A Mortgage-Backed Security is considered a kind of bond that's backed by the mortgages which make up the pooled investment. After the real estate crisis. Mortgage-backed securities (MBS) are debt obligations that represent claims to the cash flows from pools of mortgage loans, most commonly on residential. An MBS is an asset-backed security that is traded on the secondary market, and that enables investors to profit from the mortgage business without the need to. Mortgage-backed securities (MBS) are fixed-income securities that utilize mortgage loans as collateral and the source of funds for payments on the security. Investing in mortgage-backed securities requires investors to understand how their bond's performance will change with varying prepayment activity. It is. A significant widening of spreads in the agency mortgage-backed securities market, creating a potentially attractive opportunity for investors. Agency mortgage-backed securities (MBS) play an important role in Agency MBS have outperformed US Treasury bonds over longer investment horizons. Designed to deliver total return through investing in a diversified portfolio of mortgage-backed securities. Mortgage-backed securities, or MBS, are investments that take mortgages, pool them, and then sell the pools of loans to investors as a single investment. A Mortgage-Backed Security is considered a kind of bond that's backed by the mortgages which make up the pooled investment. After the real estate crisis. Mortgage-backed securities (MBS) are debt obligations that represent claims to the cash flows from pools of mortgage loans, most commonly on residential.

Association mortgage backed securities (NHA MBS) and Canada Mortgage Bond (CMB) programs which will be addressed in a separate advisory. Appendices set out. Because of their safety, European investment funds are legally allowed to hold 25% of their assets from a single issuer — other assets have a 5% limit. Most. Mortgage-backed securities are created by pooling mortgages purchased from the original lenders. Investors receive monthly interest and principal payments from. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount. Investors should exercise care to fully understand the value of any mortgage-backed investment and diligently review the applicable disclosure documents. Bonds and bond funds can be an important component of a diversified investment portfolio. They can be helpful for anyone concerned about capital preservation. bonds. Mortgage-backed securities are asset-backed, meaning they are secured by a mortgage or collection of mortgages. Investors collect the interest and pri. When you invest in mortgage-backed securities (MBS) you are purchasing an interest in pools of loans or other financial assets. As the underlying loans are. Mortgage-Backed Securities (MBS) are fixed-rate investments that represent an ownership interest in a pool of many mortgages. 'Bonds and Mortgages' are types of investments. A bond is a promise by a company or government to pay back a loan with interest. A mortgage bond is a bond backed by a pool of mortgages on a real estate asset such as a house. More generally, bonds which are secured by the pledge of. The investor pays a premium for all the work being done for them. If the pool of loans was originated for $ billion, perhaps investors will. Think of a mortgage bond as a pool of individual mortgages bundled together and sold to investors as a single security. Bottom Line. Bonds and bond funds can be an important component of a diversified investment portfolio. They can be helpful for anyone concerned about capital. investing in a variety of mortgage-backed securities with a term to maturity greater than one year Includes bonds with greater than one year to maturity. The investor receives a repay- ment of principal—namely, the “face value” of the bond—in a single lump sum when the bond matures. Investors in mortgage. A mortgage-backed security also referred to as an MBS, is an investment that begins its life as a home loan. Mortgage-backed securities are a type of bond that. Despite the negative outlook, investors have options. Senior mortgage bonds, particularly seasoned bonds backed by mortgages issued more than 15 years ago. These mortgage investments offer predictable returns and regular cash flow without the lower interest rates of government bonds or the added risk of other. Fund management. Vanguard Mortgage-Backed Securities ETF seeks to track the performance of a market-weighted U.S. mortgage-backed securities index with an.

Financing A Foreclosure

The only financing strategy you should be targeting for foreclosures is subject to. You can get financing, it has to be bought before the auction date. If you plan to finance a foreclosure purchase, you will want to obtain a preapproval from a mortgage lender. You might also consider specific loan programs. It's possible to finance a foreclosure bought at auction or from the bank. From my understanding banks will not give you a home loan to buy a property that is. In Florida, the method of foreclosure is through the judicial process, meaning the lender must file a lawsuit in state court. Purchase from bank. When foreclosed homes fail to sell on the market or through an auction, ownership of the property is transferred back to the lender. These. A foreclosed home is one in which the pre-foreclosure options have elapsed and the lender (often a bank) takes possession of the home. To find foreclosed homes in Michigan, start by combing through online databases, local real estate listings, and foreclosure auction websites. Typically, when homeowners are facing foreclosure or looking to short sell their house, it means they lack the financial means to pay the mortgage or maintain. In this blog post, we'll cover what you need to know to finance a foreclosure auction purchase with a hard money loan for properties in Washington, Oregon and. The only financing strategy you should be targeting for foreclosures is subject to. You can get financing, it has to be bought before the auction date. If you plan to finance a foreclosure purchase, you will want to obtain a preapproval from a mortgage lender. You might also consider specific loan programs. It's possible to finance a foreclosure bought at auction or from the bank. From my understanding banks will not give you a home loan to buy a property that is. In Florida, the method of foreclosure is through the judicial process, meaning the lender must file a lawsuit in state court. Purchase from bank. When foreclosed homes fail to sell on the market or through an auction, ownership of the property is transferred back to the lender. These. A foreclosed home is one in which the pre-foreclosure options have elapsed and the lender (often a bank) takes possession of the home. To find foreclosed homes in Michigan, start by combing through online databases, local real estate listings, and foreclosure auction websites. Typically, when homeowners are facing foreclosure or looking to short sell their house, it means they lack the financial means to pay the mortgage or maintain. In this blog post, we'll cover what you need to know to finance a foreclosure auction purchase with a hard money loan for properties in Washington, Oregon and.

This guide is built to help potential foreclosures, REOs, short sales and pre-foreclosures (Short Sales) whether you are a seasoned investor, or you are a. Stratton Equities offers Foreclosure Bailout Loans that are specially designed to save investment properties from having their properties being foreclosed upon. Purchasing a Foreclosed Home. If buying from a bank, you'll need to sharpen your bargaining skills and start with a lowball offer on the property you want. It's possible to finance a foreclosure bought at auction or from the bank. From my understanding banks will not give you a home loan to buy a property that is. Purchase from bank. When foreclosed homes fail to sell on the market or through an auction, ownership of the property is transferred back to the lender. These. The Attorney General has developed this website to provide information about mortgages and foreclosures in Georgia. This page also contains telephone. To summarize, buying a foreclosure property through financing in Los Angeles is an attainable goal. It requires securing finance, choosing the right agent. Foreclosure occurs when a lender seeks to seize the property used as collateral for a loan due to failure to pay. · There are typically six phases in the. To summarize, buying a foreclosure property through financing in Los Angeles is an attainable goal. It requires securing finance, choosing the right agent. In this case, the lender may decide to begin the foreclosure process. Under such circumstances, the lender, whether a bank, savings and loan or private party. Yes, usually you can buy a foreclosed property with a bank loan. But if the house is a complete disaster and the lending bank you use for. When the title to the property is in the new borrower's name they will be able to make the necessary repairs and acquire less expensive bank financing. The Attorney General has developed this website to provide information about mortgages and foreclosures in Georgia. This page also contains telephone. Typically foreclosure homes in Michigan sell for % under the current market value. This means that you will receive a large discount to purchase a bank. The foreclosure process typically commences only after a borrower has stopped repaying the loan (meaning that the loan has gone into default); the lender. Typically, when homeowners are facing foreclosure or looking to short sell their house, it means they lack the financial means to pay the mortgage or maintain. In Florida, the method of foreclosure is through the judicial process, meaning the lender must file a lawsuit in state court. Although, in general, homeowners retain their equity even after a foreclosure, there are limitations and nuances to this fact. Foreclosure is a legal process that allows lenders to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property. Learn more about the benefits of purchasing a foreclosed or distressed home.

Prediction Of Mortgage Rates For Next Five Years

Interest rates have fallen 46bps in the last five weeks, tracking a decline in Treasury yields amid bets the Fed will start cutting interest rates next month. We can expect slightly lower rates in September — perhaps in the mid- or even low-6% range — but don't expect rates to drop very steeply. The average forecast sees the 5-year fixed mortgage rate dropping another half a percentage point by the end of The most optimistic estimate is a drop of. Mortgage Rate Predictions for 20· loanDepot: Mortgage rates could fall below 6% in Q4 · BrightMLS: Year, fixed rate to hover below % in Q4. Following a two-day meeting, the U.S. central bank unanimously voted to maintain the federal funds rate range at % to %. This rate has been in place. Analysis by research firm Capital Economics suggests that rates will hit 4% by the end of The future of interest rates depends significantly on how. According to their predictions, interest rates were projected to reach % during the second and third quarters of The forecast has since been realized. 10+ Years and counting! Mortgage News Daily has provided daily rate commentary to the mortgage industry since Subscribe | Today's Mortgage Rates. The US Federal Reserve (Fed) has raised interest rates by another 25 basis points (bps) at the May meeting, bringing the rate to between 5% and %, the. Interest rates have fallen 46bps in the last five weeks, tracking a decline in Treasury yields amid bets the Fed will start cutting interest rates next month. We can expect slightly lower rates in September — perhaps in the mid- or even low-6% range — but don't expect rates to drop very steeply. The average forecast sees the 5-year fixed mortgage rate dropping another half a percentage point by the end of The most optimistic estimate is a drop of. Mortgage Rate Predictions for 20· loanDepot: Mortgage rates could fall below 6% in Q4 · BrightMLS: Year, fixed rate to hover below % in Q4. Following a two-day meeting, the U.S. central bank unanimously voted to maintain the federal funds rate range at % to %. This rate has been in place. Analysis by research firm Capital Economics suggests that rates will hit 4% by the end of The future of interest rates depends significantly on how. According to their predictions, interest rates were projected to reach % during the second and third quarters of The forecast has since been realized. 10+ Years and counting! Mortgage News Daily has provided daily rate commentary to the mortgage industry since Subscribe | Today's Mortgage Rates. The US Federal Reserve (Fed) has raised interest rates by another 25 basis points (bps) at the May meeting, bringing the rate to between 5% and %, the.

However, it raised its outlook for the fourth quarter of the following year to %, up from the previous %. The return to below the 2% inflation target is. UK interest rates now predicted to fall from % to around % by the end of with the first rate cut forecast in August or September. Long-term interest rates forecast refers to projected values of government bonds maturing in ten years 5 August © Organisation for Economic Co. Channel expects rates to remain high compared to the levels seen during the height of the COVID pandemic, when average year mortgage rates were around. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Mortgage rate forecast for next week (Sept. ) Mortgage interest rates dropped to their lowest level since February The average year fixed rate. The forecast for global growth five years from now—at percent—is at interest rates moderated the near-term impact of policy rate hikes. Chapter. During the forecast period, experts anticipate a gradual decline in year fixed mortgage rates. However, it's unlikely they will fall below % due to. The Mortgage Bankers Association believes they could fall to % by the end of the year. What Is the Mortgage Rate Forecast for the Next 3 and 5 Years? Most experts believe rates will close out at %. Based on their latest Market Participant Survey, the Bank of Canada's interest rate forecast also. Mortgage rates rose above 7% in April and these higher rates slowed the housing market. Outlook | April 18, Economic, Housing and Mortgage Market Outlook. Mortgage rates rose above 7% in April and these higher rates slowed the housing market. Outlook | April 18, Economic, Housing and Mortgage Market Outlook. Fannie Mae analysts are more pessimistic, expecting further declines in new construction and existing home sales, while forecasting mortgage rates to remain. However, it raised its outlook for the fourth quarter of the following year to %, up from the previous %. The return to below the 2% inflation target is. Historically speaking, we are currently in a relatively high interest rate environment with a key interest rate of percent, following a period shaped by. While it's not possible to make accurate UK mortgage rate predictions for the next 5 years, the Office for Budget Responsibility has forecast that mortgage. But while mortgage rate forecasts Although the central bank has "signalled" there "may be scope for a further reduction this year below 5%", the governor is. Mortgage rate predictions for this month, , , , and year mortgage rate predictions and year mortgage rate predictions. Forbes Advisor asked nearly a dozen housing experts what their forecast is for the housing market in the next five years. While most experts expect homebuyer. Expect Prime rate at % by the end of and % by the end of Read about the path of interest rates over the coming years and use WOWA's.

Best High Apr Savings Accounts

Here's a short list of good online banks with >5% APY. There are others, this is just my short list. western alliance cit sofi jenius everbank. With an APY of %1, our account is built to perform and help your money grow more than it would in traditional savings accounts, which average % APY. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. High-Rate Savings Account Features · Bank anytime, anywhere with Alliant Mobile and Online Banking · Earn our best rate on all of your money with only a $ High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. GSB Connect: Our Banking Products At % APY*, Connect High-Yield Savings gives you a higher interest rate to let your money grow faster - with the freedom. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Here's a short list of good online banks with >5% APY. There are others, this is just my short list. western alliance cit sofi jenius everbank. With an APY of %1, our account is built to perform and help your money grow more than it would in traditional savings accounts, which average % APY. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. High-Rate Savings Account Features · Bank anytime, anywhere with Alliant Mobile and Online Banking · Earn our best rate on all of your money with only a $ High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. GSB Connect: Our Banking Products At % APY*, Connect High-Yield Savings gives you a higher interest rate to let your money grow faster - with the freedom. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today.

High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Generally, if you have a longer term and larger investment, you can secure a higher interest rate upfront. Initial deposit: Most financial institutions offer. Perhaps the greatest draw of high interest savings accounts is that they bring better returns even during a recession. Raisin lists some of the most competitive. As of May , the best interest rates for high-yield savings accounts are available in the range of percent annual percentage yield (APY) or higher. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. CDs may be a good choice if you have some money in savings that you're unlikely to need right away. They offer a higher interest rate than a traditional savings. Star High-Yield Savings Account ; Balance Tier $ - $1,, ; Interest Rate % ; Annual Percentage Yield (APY) % ; Available to applicants with a Texas. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Earn more than 10x the national average rate and reach your savings goal faster with Citadel's High Yield Savings Account. You'll benefit from a great rate. Balances are federally insured for at least $, Who uses a high-yield savings account and why? An HYSA is a good option for almost everyone with savings. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. If you want easy access to your money at a high interest rate, then a High Yield Saving Account could be a great fit for you. Here's what to expect when you. New, higher rates – plus a special bonus offer! ; $, or more, % ; 60 Months, $ - $49,, % ; $50,–$99,, % ; $, or more, %. Make the easiest decision with a great savings rate. Savings Account Balance, Annual Percentage Yield (APY). Any balance, NaN. Balances are federally insured for at least $, Who uses a high-yield savings account and why? An HYSA is a good option for almost everyone with savings. Best Savings Accounts – August · Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance. Make the easiest decision with a great savings rate. Savings Account Balance, Annual Percentage Yield (APY). Any balance, NaN. Grow your savings with a high-yield savings account from Popular Direct. Put your money to work, open a high-interest savings account today with the best. SoFi, Marcus, discover, Wealthfront, CIBC, capital one. Have them all, all are fine. CIBC is the highest at 5% still. With an online high-yield savings account, you can reach your savings goals faster by earning interest at a higher rate than traditional savings accounts.

1 Kg Copper Price

1 Kilo Copper Bar - Elemental. $ or Best Offer. Free shipping. 1, sold ; 4 Kilogram kg ( lb) Element Cast Copper Bar Fine Bullion Pound Kilo Please check your input. Cu-No in kg/km. Copper price. Cu-Base. Submit. Formula As per example, this amount would be the copper surcharge for 1 km of. Copper Spot Price is less than $5 per pound. Reviewed in the United States on July 2, Copper, 1 kilo = lbs x $ Spot Price = $ per bar. Copper 1 Kilo Germania Mint Cast Bar ; 1 - 9, $, $ ; 10 or more, $, $ 1 Kilo Copper Bar - Element Design ; Quantity ; 1, $ each ; , $ each ; , $ each ; 10+, $ each. A ton of it costs $, so a gram will cost you around around 1 cent ( cent to be precise). On this page you get an overview of the current price development of the copper rate in euros, both for 1 ounce and for 1 kilogram. 1 kg of pure copper costs on average between 4 and 6 euros. The actual price, however, depends on the type of copper, which is divided into various categories. Today's copper market price is $ per pound. Tip: Use the “Advanced” button above to access technical analysis charting features for copper spot prices. 1 Kilo Copper Bar - Elemental. $ or Best Offer. Free shipping. 1, sold ; 4 Kilogram kg ( lb) Element Cast Copper Bar Fine Bullion Pound Kilo Please check your input. Cu-No in kg/km. Copper price. Cu-Base. Submit. Formula As per example, this amount would be the copper surcharge for 1 km of. Copper Spot Price is less than $5 per pound. Reviewed in the United States on July 2, Copper, 1 kilo = lbs x $ Spot Price = $ per bar. Copper 1 Kilo Germania Mint Cast Bar ; 1 - 9, $, $ ; 10 or more, $, $ 1 Kilo Copper Bar - Element Design ; Quantity ; 1, $ each ; , $ each ; , $ each ; 10+, $ each. A ton of it costs $, so a gram will cost you around around 1 cent ( cent to be precise). On this page you get an overview of the current price development of the copper rate in euros, both for 1 ounce and for 1 kilogram. 1 kg of pure copper costs on average between 4 and 6 euros. The actual price, however, depends on the type of copper, which is divided into various categories. Today's copper market price is $ per pound. Tip: Use the “Advanced” button above to access technical analysis charting features for copper spot prices.

The Element 1 Kilo Copper Bar is like a love letter to copper. This is a copper bar made of fine copper and engraved onto it is all that makes copper. Copper v/s Other Base Metals ; /1 KGS. ; /1 KGS. ; /1 KGS · ; /1 KGS · ; /1 KGS. The price of Copper will depend on the purity of the metal and if it is Demand is high and because of this, pure copper can be worth over $7 per KG in its. Pricing for Scrap Metal ; Bare Bright Wire (stripped/shiny), $ ; #1 Tubing (clean tube/ clean fine wire), $ ; #2 Tubing (paint/solder/burnt wire), $ In India, Today's Copper price is ₹/KG, and is witnessing a inclining in trend of %. Copper is a metal that can be used for various applications and is. However, the copper price, and its currency, can be changed to other values of your choice. 1. Enter total number of grams and/or kilograms: Gram of Copper. Titanium ingot CP Grade 1 contract cif main port USD/kg; Titanium ingot CP Grade 2 contract cif main port USD/kg; Titanium sponge TG 12x25mm long-term. Copper price today ; Copper Price per Ounce, $ % ; Copper Price per Ton, $8, %. You can also mix it with other metals to make strong copper alloys for various uses. copper 1 kg price comes with diameters of , , and Tensile. Open Price is USD/lb. Close Price is USD/lb. If you would like to get a daily email notification of copper price, please click the button below. COPPER BAR- 1 KILO LBS RANDOM STYLE- OUR CHOICE FINE ; Or Prime members ; get FREE delivery Thursday, September Order within ; Ships from. Amazon. Copper is expected to trade at USd/LB by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking. 1 Kg Copper Price(+). Price range. Supplier region. 1 Kilo Copper Bullion Bar (Varied Condition) ; Qty. (e)Check/Wire. Crypto ; $ $ ; $ $ ; 30+. $ $ Price Of Copper Per Kg(+) ; Cheap Wholesale · Copper Wire Scrap price per kg. $ - $ Min. order: 1 ton ; Manufacturers ensure quality at low · price. Copper Price is at a current level of , down from last month and up from one year ago. This is a change of % from last month and. price compared to gold, silver, platinum, and palladium. Now, you can purchase the 1 Kilo Elemental Copper Bar today, at JM Bullion. Bar Highlights: Arrives. Live Copper Charts and Copper Spot Price from International Copper Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. 10 products ; 1 KILO LIBERTY COPPER DESIGN FINE COPPER BAR · $ USD ; mm Autocannon Copper Bullet 1 Kilo (35 Oz) Copper Bullion · $ USD ; 1 KILO. Price applies to customers with a staalpas. For standard prices, see our scrap prices page. Bereken eenvoudig de opbrengst. Aantal kg.

What Are Etfs In Investing

In addition, investors buy and sell ETF shares with other investors on an exchange. As a result, the ETF manager doesn't have to sell holdings — potentially. Key takeaways · Exchanged-traded funds (ETFs) are pooled investment vehicles similar to mutual funds. · ETFs track a particular index and can be actively traded. An exchange-traded fund (ETF) is a basket of securities you buy or sell through a brokerage firm on a stock exchange. WILEY GLOBAL FINANCE. Exchange-traded. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage. An exchange-traded fund (ETF) is a basket of securities that tracks or seeks to outperform an underlying index. ETFs can contain investments such as stocks. Investment solutions that offer potential growth from market price appreciation, but may experience market volatility and loss of principal. An ETF (exchange-traded fund) is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual. ETFs are investment funds that track the performance of a specific index – like the STI Index or S&P Just like stocks, you can trade ETFs on a stock. ETFs. While they can be actively or passively managed by fund managers, most ETFs are passive investments pegged to the performance of a particular index. In addition, investors buy and sell ETF shares with other investors on an exchange. As a result, the ETF manager doesn't have to sell holdings — potentially. Key takeaways · Exchanged-traded funds (ETFs) are pooled investment vehicles similar to mutual funds. · ETFs track a particular index and can be actively traded. An exchange-traded fund (ETF) is a basket of securities you buy or sell through a brokerage firm on a stock exchange. WILEY GLOBAL FINANCE. Exchange-traded. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage. An exchange-traded fund (ETF) is a basket of securities that tracks or seeks to outperform an underlying index. ETFs can contain investments such as stocks. Investment solutions that offer potential growth from market price appreciation, but may experience market volatility and loss of principal. An ETF (exchange-traded fund) is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual. ETFs are investment funds that track the performance of a specific index – like the STI Index or S&P Just like stocks, you can trade ETFs on a stock. ETFs. While they can be actively or passively managed by fund managers, most ETFs are passive investments pegged to the performance of a particular index.

At JP Morgan, we're combining the built-in benefits of ETFs with our best-in-class research insights, portfolio expertise and trading capabilities. How Do I Invest in ETFs? You can use just about any broker to buy and sell shares of ETFs. It's as easy as knowing the ticker symbol for the ETF you want. ETFs don't have minimum investment requirements -- at least not in the same sense that mutual funds do. However, ETFs trade on a per-share basis, so unless your. ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. An ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges, like the New York. An exchange-traded fund (ETF) is a basket of securities you buy or sell through a brokerage firm on a stock exchange. These ETFs invest in market and sector indexes across the globe. An ETF might diversify across regions, or it might target only one region, such as Europe. Or. Top sector ETFs ; Vanguard Information Technology ETF (VGT), percent, percent ; Financial Select Sector SPDR Fund (XLF), percent, percent. ETFs are a flexible investment vehicle that can be used within a portfolio to achieve a variety of needs and objectives. Similar to a mutual fund, ETFs can. Exchange traded funds (ETFs) are a low-cost way to earn a return similar to an index or a commodity. They can also help to diversify your investments. An exchange-traded fund (ETF) is a collection of assets that trades on an exchange. ETFs are a diversified and low way to invest. An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. Since their introduction in , exchange-traded funds (ETFs) have exploded in popularity with investors. These instruments—equity portfolios tracking an. ETFs offer built-in diversification and don't require large amounts of capital in order to invest in a range of stocks, they are a good way to get started. Like mutual funds, ETFs offer investors a way to pool their money in a fund that makes investments in stocks, bonds, or other assets and, in return, to receive. Exchange-traded funds (ETFs) and other exchange-traded products (ETPs) combine aspects of mutual funds and conventional stocks. As with any investment. Exchange-traded funds (ETFs) take the benefits of mutual fund investing to the next level. ETFs can offer lower operating costs than traditional open-end funds. The proliferation of ETFs has brought with it specialized funds that reach all corners of the financial markets. ETFs may enable you to invest according to. An ETF is a basket of securities bundled together as one investment. ETFs track those underlying stocks and securities. Most ETFs trading in the marketplace are index-based ETFs. These ETFs seek to track a securities index like the S&P stock index and generally invest.

Average Cost Of Yacht Insurance

What Does it Cost to Insure a Yacht? Determining boat insurance pricing is The average yacht insurance policy costs around % of your yacht's value. Start with the basics. Let's start by describing the two basic sections of a typical boat or yacht insurance policy: physical damage and liability. The physical. However, coverage can vary between $ and $1, per year, but likely no more than $1, if you're only seeking basic coverage. There are also other crew costs, like medical and liability insurance, training, and uniforms. When you are not exploring the world or sunning on the deck in St. Gasoline, bread, homes, autos and boats. As costs of labor, parts, legal judgements and catastrophes go up the cost of boat insurance also rises. Gallagher. Cost. The best way to estimate your costs is to request a quote · Policy highlights. Known for insuring niche products like boats, Markel's boat insurance is a. A simple, liability-only boat insurance premium typically costs between $ and $ annually. When you start to cover your boat instead of just damage to. Essential for all boat owners, liability insurance covers damages and injuries to others if you're at fault in an accident. This includes costs associated with. The average cost of boat insurance is generally between $ – $ per year, but this can vary greatly based on the boat's size and value, owner experience. What Does it Cost to Insure a Yacht? Determining boat insurance pricing is The average yacht insurance policy costs around % of your yacht's value. Start with the basics. Let's start by describing the two basic sections of a typical boat or yacht insurance policy: physical damage and liability. The physical. However, coverage can vary between $ and $1, per year, but likely no more than $1, if you're only seeking basic coverage. There are also other crew costs, like medical and liability insurance, training, and uniforms. When you are not exploring the world or sunning on the deck in St. Gasoline, bread, homes, autos and boats. As costs of labor, parts, legal judgements and catastrophes go up the cost of boat insurance also rises. Gallagher. Cost. The best way to estimate your costs is to request a quote · Policy highlights. Known for insuring niche products like boats, Markel's boat insurance is a. A simple, liability-only boat insurance premium typically costs between $ and $ annually. When you start to cover your boat instead of just damage to. Essential for all boat owners, liability insurance covers damages and injuries to others if you're at fault in an accident. This includes costs associated with. The average cost of boat insurance is generally between $ – $ per year, but this can vary greatly based on the boat's size and value, owner experience.

Coverage. Allstate offers a very comprehensive lineup of options for boat coverage, including: Watercraft liability coverage; Property coverage; Repair costs. If your boat is being repaired because of damage that's covered by your insurance policy, Boat Rental Reimbursement will help pay the cost to rent a boat. (Cruise lines require charter boats that serve their passengers to carry a minimum $1 million P&I policy.) The price of excess insurance is relatively low. Boat insurance costs range from $ to $ a year—a small price to pay for the protection it provides. For example, last year, SC boating accidents. As far as cost, broadly you can expect from 1% to 3% of agreed hull value. The range of prices will depend on the specific coverage, where you. On average, sailboat owners typically pay between $ and $1, annually to insure their sailboats. However, the cost can be higher or lower, depending on the. BoatUS and GEICO have teamed up to bring boaters a great boat insurance policy at a great price. Serviced by boating experts our coverage options for boaters. Florida boat insurance cover costs $ per year, on average, whereas medium-cost states have an annual policy cost of $, on average. There is no definitive or distinctive sum of money that can be ascertained however an average boater pays a few hundred dollars a year for boat insurance, it. The average cost of watercraft/boat insurance in South Carolina is $ per year or $44 per month. However, this cost differs due to a number of factors. By contrast, a boat policy offers a flat deductible, typically of $, $ or $1, Because yachts inherently incur more risk due to their size and. Boat Insurance Coverage FAQs · Medical payments, $5, · $1, limit Personal effects, $ deductible · Uninsured boaters liability, between $, and. But, sailboat insurance usually costs a few hundred dollars a month, or between 1% and 5% of your vessel's value. For instance, if you have a $, sailboat. Coverage. Allstate offers a very comprehensive lineup of options for boat coverage, including: Watercraft liability coverage; Property coverage; Repair costs. There are also other crew costs, like medical and liability insurance, training, and uniforms. When you are not exploring the world or sunning on the deck in St. What Does it Cost to Insure a Yacht? Determining boat insurance pricing is The average yacht insurance policy costs around % of your yacht's value. The average cost can be between $$ or even well over $1, It depends on the type of boat, the length, the age, how many you rent out, and more. Do get. For example, we don't require a marine survey to purchase your policy, which could cost around $ for a foot boat. Get a boat insurance quote from. You could insure your exact boat in the Great Lakes for about $$ per year, full coverage. The policy will state "thou shalt never take. The average annual cost for boat insurance is dollars. Since this is the average, some policies are cheaper, around dollars, and others are nearly