wwwsimf.ru

News

Forbes Best In State Wealth Advisors 2019

Edwin Waingart has been recognized as a Best-in-State Wealth Advisor by Forbes. Managing Partners, Bill Whichard and John Woolard, were proud to be named to Forbes' list of the Best-in-State Wealth Advisors in North Carolina from to. "The Forbes ranking of Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through. February 26, – Randy Carver, RJFS Financial Advisor was recognized on Forbes list of Best-In-State Wealth Advisors, as one of the top advisors in Ohio. Financial Advisor, - , - Best Place to Work for Forbes' Best-In-State Wealth Advisors, developed by SHOOK Research, is based. - Forbes Magazine named Laurie Blackburn, one of the Forbes Magazine's top Women Wealth Advisors. * Forbes Best-in-State Wealth Management Teams. Good Life founder, Conor Delaney earned the 38th place on Forbes' Best-in-State Next Generation Wealth Advisors List, for the state of Pennsylvania. Forbes Best-In-State Wealth Advisors: Awarded February ; Data compiled by SHOOK Research LLC based on the time period from 6/30/19 - 6/30/ In August of , Carolyn Taylor and Candise Holmlund were nominated for Shook Research's Best-in-State Wealth Advisors list. Both were invited to. Edwin Waingart has been recognized as a Best-in-State Wealth Advisor by Forbes. Managing Partners, Bill Whichard and John Woolard, were proud to be named to Forbes' list of the Best-in-State Wealth Advisors in North Carolina from to. "The Forbes ranking of Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through. February 26, – Randy Carver, RJFS Financial Advisor was recognized on Forbes list of Best-In-State Wealth Advisors, as one of the top advisors in Ohio. Financial Advisor, - , - Best Place to Work for Forbes' Best-In-State Wealth Advisors, developed by SHOOK Research, is based. - Forbes Magazine named Laurie Blackburn, one of the Forbes Magazine's top Women Wealth Advisors. * Forbes Best-in-State Wealth Management Teams. Good Life founder, Conor Delaney earned the 38th place on Forbes' Best-in-State Next Generation Wealth Advisors List, for the state of Pennsylvania. Forbes Best-In-State Wealth Advisors: Awarded February ; Data compiled by SHOOK Research LLC based on the time period from 6/30/19 - 6/30/ In August of , Carolyn Taylor and Candise Holmlund were nominated for Shook Research's Best-in-State Wealth Advisors list. Both were invited to.

The Forbes Next-Gen Wealth Advisors rankings , developed by SHOOK Research, is based on an algorithm of qualitative criterion, mostly gained through. Rankings based on data as of September 30 of prior year.) Forbes "Best-in-State Wealth Advisors", (Published annually Jan – April. Rankings based on. Forbes Best In State Wealth Advisors, created by SHOOK Research. Presented in Feb based on data gathered from June to June 30, Advisors. Jake – Best-in-State Next Generation Wealth Advisors *The Forbes ranking of America's Top Next Generation Wealth Advisors, developed by SHOOK Research. Granite State Wealth Management is pleased to announce that Robert has been named to the Forbes' Best-In-State Next-Gen Wealth Advisors list for NEW YORK (February 8, ) – Forbes and SHOOK Research will host the third annual Top Advisor Summit, an unprecedented gathering of America's preeminent wealth. Robert Vingi, David McCallum, and Wendy Brewer have all been named on the Forbes Best-in-State Wealth Advisor ranking. Robert and David have been on the. RBC Wealth Management is pleased to announce that Rick has been named to the Forbes/SHOOK Best-In-State Wealth. Advisor list in the U.S. Best-in-state. Forbes Best In State Wealth Advisors, created by SHOOK Research. Presented in April based on data gathered from June to June 32, Forbes Best-In-State Wealth Advisors: Awarded February ; Data compiled by SHOOK Research LLC based on the time period from 6/30/17 - 6/30/18 (Source. Management office, has been named to Forbes Magazine's list of America's Best-in-State. Wealth Advisors. Forbes' Best-in-State Wealth Advisors list. We are proud to congratulate Vince DiLeva, Eric Pritz, David Johnson, and Kyle Smith for their recognition in the Forbes Best-In-State Wealth Advisors. Janney Montgomery Scott LLC, a leading full-service wealth management, financial services, and investment banking firm, is pleased to announce that Edward. Aaron placed on the Forbes “Best-In-State Wealth Advisors” list for the San Francisco region in , , and In he also ranked on Forbes “Top. The Forbes ranking of America's Top Wealth Management Teams Best-In-State, developed by SHOOK Research, is based on an algorithm of qualitative criteria. *******The Forbes ranking of America's Top Wealth Management Teams Best-In-State, developed by SHOOK Research, is based on an algorithm of qualitative. Crest Capital Ranks #2 on Forbes' List of the Best-In-State Wealth Advisors · David Molnar (#) Named On Barron's Top 1, Financial Advisor Ranking. Stephen and Brian have been named as Forbes Best-In-State Wealth Advisors (). Forbes Best-In-State Wealth Advisors: Awarded April ; Data. July Forbes | SHOOK Best-In-State Top Financial Security Professionals ; April Forbes | SHOOK Top Wealth Advisors ; April Forbes | SHOOK. Awards · Leah Jones ranks on Forbes' Top Women Wealth Advisors Best-in-State list · Jeff Leventhal honored on Barron's 20list · Leah Jones ranks.

Types Of Funding Rounds For Startups

Funding rounds are typically referred to as Series A, B, C and so on, and each round is designed to provide you with the funding you need to. The seed round is initiated to help a small company start their business operations. Generally speaking, seed stage venture capital is usually acquired when the. Learn about the different stages of series seed funding from Series A funding, to Series B, and eventually Series E funding including: the process. Typically, startups go through several funding rounds before an IPO – Pre-Seed, Seed, Series A, B, C, and sometimes D or E. But the exact number depends on the. Funding Types ; pre_seed, Pre-Seed ; seed, Seed ; angel, Angel ; equity_crowdfunding, Equity Crowdfunding. The initial funding rounds of a start-up are often referred to as seed funding. At this stage, investors invest in the founder, the idea, and the company's. What are the various types of funding rounds? · Pre-Seed: The earliest type of funding round, in which a company raises money from friends, family, and other. 1) Sources of Seed Capital: Explore diverse funding sources from venture capital to angel investors and learn how to leverage them effectively. Funding rounds are lumped into three groups: Series A, Series B, and Series C funding, each corresponding with the stage of the company. Funding rounds are typically referred to as Series A, B, C and so on, and each round is designed to provide you with the funding you need to. The seed round is initiated to help a small company start their business operations. Generally speaking, seed stage venture capital is usually acquired when the. Learn about the different stages of series seed funding from Series A funding, to Series B, and eventually Series E funding including: the process. Typically, startups go through several funding rounds before an IPO – Pre-Seed, Seed, Series A, B, C, and sometimes D or E. But the exact number depends on the. Funding Types ; pre_seed, Pre-Seed ; seed, Seed ; angel, Angel ; equity_crowdfunding, Equity Crowdfunding. The initial funding rounds of a start-up are often referred to as seed funding. At this stage, investors invest in the founder, the idea, and the company's. What are the various types of funding rounds? · Pre-Seed: The earliest type of funding round, in which a company raises money from friends, family, and other. 1) Sources of Seed Capital: Explore diverse funding sources from venture capital to angel investors and learn how to leverage them effectively. Funding rounds are lumped into three groups: Series A, Series B, and Series C funding, each corresponding with the stage of the company.

Series A funding, (also known as Series A financing or Series A investment) means the first venture capital funding for a startup. · Receiving a Series A round. Pre-seed startup capital is the first round of funding for many startups. During this stage, founders are usually still spearheading most efforts at the startup. Funding Types ; pre_seed, Pre-Seed ; seed, Seed ; angel, Angel ; equity_crowdfunding, Equity Crowdfunding. The seed round is initiated to help a small company start their business operations. Generally speaking, seed stage venture capital is usually acquired when the. Self-Funding, Pre-Seed Funding, or Bootstrapping · Family and Friends · Small Business Loans · Crowdfunding · Angel Investors · Venture Capital Funding · Seed Funding. Funding rounds provide outside investors the opportunity to invest cash in a growing startup in exchange for equity or partial ownership of that startup. When. The seed round is the first official funding stage. Here, early-stage startups exchange equity for capital to finance growth initiatives such as product. Crowdfunding is a method of raising capital from a large number of individuals, typically through online platforms, to fund a project or business venture. It. Purpose: The primary purpose of a seed funding round is to provide the necessary capital for a startup to develop a proof of concept, build a minimum viable. Startup companies go through 4 main funding rounds: seed, series A, series B, and series C. After that, they can reach an IPO and be listed on the public stock. If you've never heard about pre-seed funding, equity stake, or venture capital funds, we are going to dive into how to raise funds for startups, and the. What are funding rounds? Fundraising rounds are about securing the right amount of capital to support your startup. Generally speaking, between seed and exit. Venture financing usually takes place in “rounds,” which have traditionally had names and a specific order. First comes a seed round, then a Series A, then. The seed round is the first round of funding that a startup receives, typically from angel investors, friends and family, and occasionally venture capital firms. Pre-seed, seed, series A, series B, to IPO. Find out what each round means, the criteria, the type of investors, and more. Common types of funding options for startups: Bootstrapping, crowd funding, angel investors, venture capitalists, accelerators and incubators. Understanding Startup Funding Rounds ; Series A Funding: Laying the Foundation for Scaling · Objectives of Series A startup funding: · Typical investors and. Seed or Angel rounds may involve crowdfunding and are usually for startups looking to raise less than $1 million (typically $25K – $K per angel investor). In , the median pre-money valuation seed round was $6 million. Most founders can expect to give away at least 10 percent of their startup during the initial. Startup funding rounds are a critical part of a company's journey from a small startup to a large public company. Each round serves a specific purpose, whether.

Transfer Pricing Contract

Multinational companies have typically a defined transfer pricing system with a written Transfer Pricing (“TP”) policy including a definition of methods, mark-. You will find more guidance on Contract manufacturing at TPguidelines Transfer Pricing Guidelines. Logo. MENUMENU. Search. Operational transfer pricing (“OTP”) focuses on the details of how practical these policies actually are to implement for the business and the best way to do so. Create your own transfer pricing compliant agreements with ease. There is a quick and easy way to create inter-company agreements, without needing a lawyer or. The time and money spent by the group on transfer pricing advice and documentation may be wasted, and the group may be subject to substantial. For transfer pricing purposes, the nature of the relevant intercompany transaction is the provision of a manufacturing service. Contract manufacturing is also. This article addresses the importance of accurate intercompany agreements and transfer pricing processes, and provides a summary of supporting TP technology. The Company and each of its Subsidiaries are in compliance in all material respects with all applicable transfer pricing Laws and regulations. A standard clause that provides for balancing payments to be made under an intra-group service agreement to compensate a party for additional tax (or decrease. Multinational companies have typically a defined transfer pricing system with a written Transfer Pricing (“TP”) policy including a definition of methods, mark-. You will find more guidance on Contract manufacturing at TPguidelines Transfer Pricing Guidelines. Logo. MENUMENU. Search. Operational transfer pricing (“OTP”) focuses on the details of how practical these policies actually are to implement for the business and the best way to do so. Create your own transfer pricing compliant agreements with ease. There is a quick and easy way to create inter-company agreements, without needing a lawyer or. The time and money spent by the group on transfer pricing advice and documentation may be wasted, and the group may be subject to substantial. For transfer pricing purposes, the nature of the relevant intercompany transaction is the provision of a manufacturing service. Contract manufacturing is also. This article addresses the importance of accurate intercompany agreements and transfer pricing processes, and provides a summary of supporting TP technology. The Company and each of its Subsidiaries are in compliance in all material respects with all applicable transfer pricing Laws and regulations. A standard clause that provides for balancing payments to be made under an intra-group service agreement to compensate a party for additional tax (or decrease.

The APA is an agreement made between a taxpayer and a tax authority on an appropriate transfer pricing methodology(TPM) and an ALP range for that taxpayer's. This Transfer pricing Agreement (this "AGREEMENT") is entered into as of this 31st day of December by and between XYZ, Inc. (XYZ) and YYY Technologies, Inc. . Transactions can be deemed controlled in terms of transfer price formation in case when on behalf of the principal-taxpayer the non-resident agent carried out. Yes, India has an Advance Pricing Agreement (APA) program that allows taxpayers to enter into agreements with the tax authorities to determine the transfer. High-quality transfer pricing documentation allows the examining agent to rely on the taxpayer's analysis of functions, risks, intangibles, value drivers, etc. Should multinational enterprises using principal structures with limited risk distributors, limited risk service providers and toll or contract manufacturing. Transfer pricing analysis, commonly understood as examining economic substance, in reality examines whether related parties have the functional and financial. Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. For taxpayers, it is essential to limit the risks of economic double taxation. The OECD Transfer Pricing Guidelines provide guidance on the application of the “. transfer pricing analysis). It is both Parties' understanding that the transaction contemplated by this Agreement, as well as any penalties or interest. Transfer pricing refers to the terms and conditions of transactions between connected parties, such as companies within the same group. The document that keeps the transactions and activities of such a multinational group together is called as an Inter Corporate Agreement (ICA). One of the biggest challenges in transfer pricing is ensuring that your business model and transfer pricing policy translates into a simple intercompany. Can I create a contract for intercompany billing with transfer price rules? Yes, but only if you derive rates for an intercompany contract based on an. (i) The probable cost may differ from the proposed cost and should reflect the Government's best estimate of the cost of any contract that is most likely to. Transfer pricing issues arise whenever any goods, services (i.e., marketing, R&D, management) or intangibles (i.e., patent, trade name or trade-mark rights) are. The APA Program provides an alternative dispute resolution mechanism for taxpayers and the IRS to resolve complex international transfer pricing cases. Advance pricing agreements (APAs) and safe harbors are simplification measures aimed at reducing the monitoring burden for revenue authorities, while protecting. Transfer pricing is a set of rules that exists to make sure any company with subsidiaries in another market – or in multiple markets – trades with those. Q: Can we put off implementing intercompany agreements until we need to deal with a tax challenge? Doing this is a very bad idea, for three reasons.

How To Get Money For Gold

Auctions. If you have any rare or unique gold items, an auction might be your best option. Auctions attract collectors and enthusiasts who are willing to pay. If you chose to shop around we're confident you'll find our pricing the best. Selling gold in Milwaukee has become a great way to turn unused or broken items. Selling unwanted jewellery is simple, safe and quick, a great way to make money from gold that might simply be lying around. From 9ct to 24ct you can get a. Depending on how many grams of gold are in the existing ring, you could be looking at a sum of between $70 (£50) to $ (£). 5 ways to buy and sell gold · 1. Gold bullion · 2. Gold futures · 3. ETFs that own gold · 4. Mining stocks · 5. ETFs that own mining stocks. Gold & silver at your fingertips Keep track of your spending and investments, always. Instantly buy precious metals at the lowest price from vaults across the. A higher profit from investing in gold can be earned by becoming a partner of the Gold Affiliate program. The service includes the sale of jewelry items from. In fact, it's unusual for typical banks to sell any precious metals. And even when they do, their selection is limited. However, you can readily purchase gold. This is one of the main reasons that people buy this metal so that they can get money whenever they need it. Although the prices of gold fluctuate depending on. Auctions. If you have any rare or unique gold items, an auction might be your best option. Auctions attract collectors and enthusiasts who are willing to pay. If you chose to shop around we're confident you'll find our pricing the best. Selling gold in Milwaukee has become a great way to turn unused or broken items. Selling unwanted jewellery is simple, safe and quick, a great way to make money from gold that might simply be lying around. From 9ct to 24ct you can get a. Depending on how many grams of gold are in the existing ring, you could be looking at a sum of between $70 (£50) to $ (£). 5 ways to buy and sell gold · 1. Gold bullion · 2. Gold futures · 3. ETFs that own gold · 4. Mining stocks · 5. ETFs that own mining stocks. Gold & silver at your fingertips Keep track of your spending and investments, always. Instantly buy precious metals at the lowest price from vaults across the. A higher profit from investing in gold can be earned by becoming a partner of the Gold Affiliate program. The service includes the sale of jewelry items from. In fact, it's unusual for typical banks to sell any precious metals. And even when they do, their selection is limited. However, you can readily purchase gold. This is one of the main reasons that people buy this metal so that they can get money whenever they need it. Although the prices of gold fluctuate depending on.

Gold coins and bars approved for IRAs include: Gold American Eagle Bullion Coins, Gold American Eagle Proof Coins, Gold American Buffalo Proof Coins. Typically many scrap gold dealers, particularly the "Cash for Gold" ones, only pay a fraction of the intrinsic value of the gold, perhaps only. Check the Current Market Prices: If you have the gold that you want to exchange for cash, keep tracking the fluctuations in the market price of gold every now. We have a functional currency. How Gold Became Money. As the global economy grew and intertwined, economic participants converged on the good that best. You have several options to consider, including local jewelry stores, pawnshops, auctions and online gold buyers. 1. Purchase physical gold. Bars · 2. Invest in gold stocks. You can invest in gold without ever touching a flake of it by purchasing shares of gold mining. – Jewelry stores or pawn shops: Lots of local jewelry stores buy used jewelry, and while pawn shops generally offer the quickest cash, they usually pay less. If. At maturity or by request, you can redeem your holdings in physical gold or cash. The Most Affordable Way to Buy Gold: Physical Gold or ETFs? Key Financial. After you buy gold, how do you sell it? · The first step is determining the current market value of your gold. · After establishing its value, you have multiple. If you want to sell your gold jewelry, the best way is to go to local gold buyer or pawn shop in Allen and offer it for sale. If you have bullion bars and coins. Yes it is possible to make money buying and selling them. It is also possible to lose money buying and selling them. How much you can make (or. Local coin stores are an excellent option for selling gold, especially if you have coins and bars made of precious metals. These stores not only buy gold for. Getting a gold coin or piece of gold jewelry appraised can serve as a sort of insurance policy. If you send the gold through the mail as part of your sale and. When selling gold jewelry, make an inventory list of any jewelry items you plan to sell. Then organize the items into piles of what you think is most valuable. The ANA urges everyone to be wary of cold-call solicitations or mobile offices, set up in temporary locations such as motels, offering instant cash for gold and. There are a large number of opportunities for a profitable investment on a small budget. The purchase of gold provides an opportunity to save and increase. Yes, we will give you your cash offer if accepted in hand within minutes. All you have to do is bring in your gold to any of our locations and we will make you. You can sell gold for cash in India via the MobiKwik app. This app not only helps you invest in digital gold, it also helps to sell the gold that you have. Muthoot Gold Point is India's No.1 safe & most trusted gold buyer, offers you % transparent process to sell gold online for cash. Get upto ₹ as. Sell your gold securely online for cash. Get free estimates and free insured shipping. Highest payouts guaranteed. Turn your gold into cash with Alloy today.

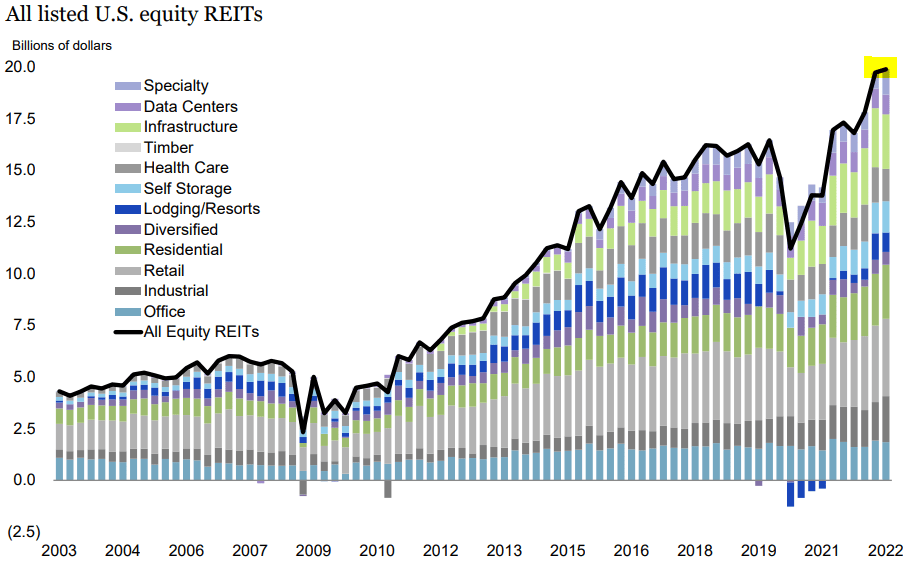

Reits Stock Price

ALPS Active REIT ETF REIT:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/26/24 · 52 Week Low The Fund seeks investment results that correspond, before fees and expenses, to the price and yield performance of the Indxx REIT Preferred Stock Index. These are all the actively traded REITs (Real Estate Investment Trusts) on the US stock market. Stocks. American Tower REIT ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - These are all the actively traded REITs (Real Estate Investment Trusts) on the US stock market. Stocks. Discover real-time ARMOUR Residential REIT, Inc. (ARR) stock prices, quotes, historical data, news, and Insights for informed trading and investment. The following table is a list of publicly traded REITs and REOCs. Click on the name of a company to visit its website. Click on the ticker symbols of the. REITs' track record of reliable and growing dividends, combined with long-term capital appreciation through stock price increases, has provided investors with. Latest Stats · Vanguard REIT ETF [VNQ]. · iShares U.S. Real Estate ETF [IYR]. · iShares Residential Real. ALPS Active REIT ETF REIT:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/26/24 · 52 Week Low The Fund seeks investment results that correspond, before fees and expenses, to the price and yield performance of the Indxx REIT Preferred Stock Index. These are all the actively traded REITs (Real Estate Investment Trusts) on the US stock market. Stocks. American Tower REIT ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - These are all the actively traded REITs (Real Estate Investment Trusts) on the US stock market. Stocks. Discover real-time ARMOUR Residential REIT, Inc. (ARR) stock prices, quotes, historical data, news, and Insights for informed trading and investment. The following table is a list of publicly traded REITs and REOCs. Click on the name of a company to visit its website. Click on the ticker symbols of the. REITs' track record of reliable and growing dividends, combined with long-term capital appreciation through stock price increases, has provided investors with. Latest Stats · Vanguard REIT ETF [VNQ]. · iShares U.S. Real Estate ETF [IYR]. · iShares Residential Real.

An increase in interest rates would translate into a decrease in mortgage REIT book values, driving stock prices lower. In addition, mortgage REITs get a. Stock Quote: TSE ; Price. ; Change. ; Volume. , ; % Change. % ; High. While REITs may offer solid dividends, share prices tend to be volatile and are especially sensitive to rising interest rates. The most common type of REIT is. Find the latest ALPS Active REIT ETF (REIT) stock quote, history, news and other vital information to help you with your stock trading and investing. Previous Close ; Open ; Bid x --; Ask x --; Day's Range - ; 52 Week Range - ; Volume ; Avg. Volume 0; Net. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M. Returns are historical and include change in share price and reinvestment of all distributions. An investor cannot invest directly in an index and index. Index · Domestic Stock - Sector-Specific · Real Estate · % · Note · $ · as of 08/30/ · $ REIT Stocks News ; $SPX · 5, (+%) ; SPY · (+%) ; $DOWI · 41, (+%) ; DIA · (+%) ; $IUXX · 19, (+%). Price · $ · $ (%) · $ · $ · $ (%) · Note · Search for more historical price information. These are the top REIT companies in India: #1 BROOKFIELD INDIA REIT #2 MINDSPACE BUSINESS REIT #3 NEXUS SELECT TRUST #4 EMBASSY OFFICE REIT. ONL | Complete Orion Office REIT Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. View REITs (BK) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo. All stock quotes on this website should be considered as having a hour delay. * wwwsimf.ru does not provide financial advice and does not issue. SITE Centers Corp SITC. Price: $ Daily change: N/A · Chimera Investment Corp CIM. Price: $ Daily change: N/A · Medalist Diversified REIT Inc MDRR. Link REIT logo. Link REIT. HK In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. Exchange Traded Products. Bonds. Traded Products Listings Directory. Instrument Type. Stocks, ETFs, Indices, REITs. Filter. Symbol. Name. AAT, AMERICAN ASSETS. share as of the relevant ex-dividend date. Designed to Effective 12/9/19 the market price returns are calculated using the official closing price. Share Value Transparency: While the market price of a publicly traded REIT is readily accessible, it can be difficult to determine the value of a share of a non. Get MSCI US REIT IDX .RMZ:MSCI) real-time stock quotes, news, price and financial information from CNBC.

Where Can I Get A Personal Loan At

Get prequalified for the best personal loan rate for you. Use our personal loans marketplace to get a loan for debt consolidation, major purchases and more. Personal loan The Conexus personal loan is a perfect fit for members looking to supplement their savings to finance their next big thing - be it a purchase, a. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. Use a personal loan. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. What are the requirements for a personal loan? · Have a valid U.S. SSN. · Be at least 18 years old. · Have a minimum individual or household annual income of at. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from $ - $, no application or origination fees, & terms up to 60 months. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Get prequalified for the best personal loan rate for you. Use our personal loans marketplace to get a loan for debt consolidation, major purchases and more. Personal loan The Conexus personal loan is a perfect fit for members looking to supplement their savings to finance their next big thing - be it a purchase, a. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. Use a personal loan. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. What are the requirements for a personal loan? · Have a valid U.S. SSN. · Be at least 18 years old. · Have a minimum individual or household annual income of at. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from $ - $, no application or origination fees, & terms up to 60 months. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today!

If you're new to credit, the best place to get a first-time personal loan is your current bank or credit union. If you already have a checking or savings. An unsecured personal loan is a great choice to consolidate debt, or to pay for home improvements, a wedding, or a vacation. We can help you out with our personal loan so that you can stay on budget with stable payments. A Vancity personal loan lets you borrow money predictably and stress-free. Borrow for big one-time expenses like home renos, travel, or weddings. Compare the best personal loan lenders, including LightStream, SoFi, LendingClub and others. Shop personal loans and pre-qualify with multiple online loan. Learn the fundamental differences between a personal loan and line of credit. CIBC helps you understand the workings of each. For example, a bank loan gives. At Huntington, we offer both unsecured and secured personal loans. Unsecured personal loans allow you to obtain a loan primarily based on your credit report. Personal loans from OneMain can help consolidate debt or fund a major purchase. Apply online for loans of up to $ with fixed rates & payments. How do I qualify for a Ridgewood Personal Loan? You must be a resident of New York, New Jersey or Connecticut, be at least 18 years old and meet Ridgewood's. KeyBank offers unsecured personal loans with a fixed rate that requires no collateral. Find a low-interest-rate loan that works for you. Apply today. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Easily apply for a personal loan online in 3 steps. · Prequalify. Find the rate that you qualify for in 60 seconds with no commitment. · Choose your loan terms. A personal loan from SouthState offers quick approval for a big purchase, debt consolidation or unexpected expenses. You can manage your loan using Online or. Personal loan rates as low as % APR With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher. Get an American Express® Personal Loan in three simple steps: · 1. Check for an offer. Simply log in to your American Express online account to see if you are. Check your rate for an online personal loan in minutes without affecting your credit score. Get funded in as fast as 1 business day. Enjoy low rates and flexible terms from Georgia United's Personal Loans. Our loans are approved and granted quickly, giving you access to the funds you need. A Libro Coach can help with a personal loan to set you on the right track to maximize the correct use of a loan or line of credit. Personal loan interest rates as low as % APRFootnote 1,Footnote 2 The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with. How to Apply for a Personal Loan · 1. Apply In Minutes. Get customized loan options based on what you tell us. · 2. Choose a Loan Offer. Select the rate, term.

Llc For Fba

Starting an LLC for your Amazon FBA business offers asset protection, a professional image, potential tax benefits, and privacy, allowing separation between. Comprehensive, step-by-step guide to registering an LLC in Wyoming and starting an Amazon store. Sell with confidence and protect your assets. When you first start selling inventory on Amazon and you have a small business, you may not need an LLC. If you haven't accrued any debt, you may not need. A limited liability company is a business entity type that combines the pass-through taxation of a partnership or sole proprietorship with the limited. Which entity is best to sell on Amazon? U.S. LLC e-commerce and verification experts From LLC formation to utility bill and taxation (). Filing Requirements for Different Classification of LLCs. Depending on its tax classification and ownership structure, an LLC may need to file different types. My decision for my business was to create an LLC first before starting out. If you decide to just use a personal account then it may work too. How to Create an LLC for Amazon FBA? · 1. Choose a Company Name · 2. Hire a Registered Agent · 3. Fill out an Operating Agreement · 4. File with the Secretary of. We see many Amazon Sellers incorporate as a limited liability company (LLC). Forming an LLC allows you to receive the incorporation benefits listed above. Starting an LLC for your Amazon FBA business offers asset protection, a professional image, potential tax benefits, and privacy, allowing separation between. Comprehensive, step-by-step guide to registering an LLC in Wyoming and starting an Amazon store. Sell with confidence and protect your assets. When you first start selling inventory on Amazon and you have a small business, you may not need an LLC. If you haven't accrued any debt, you may not need. A limited liability company is a business entity type that combines the pass-through taxation of a partnership or sole proprietorship with the limited. Which entity is best to sell on Amazon? U.S. LLC e-commerce and verification experts From LLC formation to utility bill and taxation (). Filing Requirements for Different Classification of LLCs. Depending on its tax classification and ownership structure, an LLC may need to file different types. My decision for my business was to create an LLC first before starting out. If you decide to just use a personal account then it may work too. How to Create an LLC for Amazon FBA? · 1. Choose a Company Name · 2. Hire a Registered Agent · 3. Fill out an Operating Agreement · 4. File with the Secretary of. We see many Amazon Sellers incorporate as a limited liability company (LLC). Forming an LLC allows you to receive the incorporation benefits listed above.

Whilst I have only recently undertaken the FT FBA USA Course, I am excited to see the results, given everything else I have gleaned and benefited from Fast. If you're considering starting an Amazon FBA business, you may be wondering if you need to form a Limited Liability Company (LLC). An LLC, or limited liability company, is an entity formed to protect your personal assets from lawsuits connected with your business. Most states do not require you to be specific about the purpose of your LLC. Instead, a statement such as “The purpose of the Limited Liability Company is to. How to Create an LLC for Your Amazon Business · Set up Your Business Name · Choose a Registered Agent · File Articles of Organization · Get an EIN · Complete. If you're selling on Amazon just through an LLC (or with no legal entity at all), then you're paying way more tax than you need to. With Fulfillment by Amazon (FBA), you store products in our fulfillment centers, and we pick, pack, ship, and deliver © , wwwsimf.ru Services LLC. Yes, you will need an LLC. Amazon requires insurance for professional sellers. You will have a hard time getting limited liability insurance to sell products. An LLC is the starting point of your Amazon journey. You're putting your business on the government's “grid,” so to speak, with even more annoying taxes. An S Corp is a special kind of corporation, only available to U.S. citizens and resident aliens, that offers the same legal protection as an LLC but often more. As a US citizen, you can easily file for an LLC through your state's website or with a service like BusinessZen and LegalZoom. LLCs are one of the simplest business structures to set up, but if your other option is to start out as a sole proprietor, it takes a bit more effort. The quick answer is mostly no, but it could be. Although you are not required to create an LLC to sell products on Amazon, you might do so for a few significant. I spent a whole year researching and gaining knowledge on things such as taxes, bank accounts, EIN numbers, LLC, Amazon seller accounts and so much more. The following guide will give you the necessary information to get your Amazon Seller LLC off the ground in no time. Forming an LLC for Amazon FBA business can provide numerous benefits, including liability protection, tax savings, and a professional image. An LLC is a special type of business entity that allows for more flexibility than a sole proprietorship or partnership. One of the benefits of. We'll provide you with step-by-step instructions and valuable insights on how to form an LLC for your dropshipping business. Do you need an LLC to sell on Amazon? Read our guide to learn more about LLCs and to find out if you should start an LLC for your Amazon FBA business. No, forming an LLC is not mandatory to sell on Amazon in You can create an Amazon seller account and begin selling products under your own name.

What Is Shorting A Share

Here's a hypothetical example of short selling: You find XYZ stock valued at $ per share and believe the value will fall, so you decide to open a short. All you do is to phone your broker and put an order in saying that you wish to place your shares for sale at, for arguments sake, double today's price. As they. A short is you basically take out a sorta loan and borrow a stock from your broker to a stock that is on a down trend. And if it goes down you pay back the. Track short positions in UK listed companies. Track positions by fund manager or by company. This table shows the interest rate that must be paid by a short seller of US:PLUG to the lender of that security. This fee is shown as an annual percentage rate. What is short selling in share market When a shareholder gives away shares that he does not own during its sale, this is known as short selling. In short. In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. In such a case you can borrow the shares or securities from your broker by paying a margin fee. You also have to ensure that you return the borrowed shares to. Short selling is a trading strategy to profit when a stock's price declines. While that may sound simple enough in theory, traders should proceed with caution. Here's a hypothetical example of short selling: You find XYZ stock valued at $ per share and believe the value will fall, so you decide to open a short. All you do is to phone your broker and put an order in saying that you wish to place your shares for sale at, for arguments sake, double today's price. As they. A short is you basically take out a sorta loan and borrow a stock from your broker to a stock that is on a down trend. And if it goes down you pay back the. Track short positions in UK listed companies. Track positions by fund manager or by company. This table shows the interest rate that must be paid by a short seller of US:PLUG to the lender of that security. This fee is shown as an annual percentage rate. What is short selling in share market When a shareholder gives away shares that he does not own during its sale, this is known as short selling. In short. In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. In such a case you can borrow the shares or securities from your broker by paying a margin fee. You also have to ensure that you return the borrowed shares to. Short selling is a trading strategy to profit when a stock's price declines. While that may sound simple enough in theory, traders should proceed with caution.

Short selling is a kind of intraday or derivative strategy for trading. With short selling, investors can borrow shares from brokers and sell them as soon as. Short calls are meant for either speculation or to indirectly hedge exposure. By shorting, you could hedge exposure and create a short position. If the stock. It isn't a good sign if a company is being heavily shorted. Investors who short sell are betting against the success of the shares. Keeping up to date with. Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short. A sell stop order is entered at a stop price. A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. If the price. A loss occurs when the stock price goes up, requiring you to repurchase the shares at a higher price than you sold them for. This data is the official short interest data, as provided by NYSE. Short Interest is the total number of open short positions of a security. Days to Cover is. Refers to the sale of a security which you do not own. A stock-borrow is secured to cover the delivery of the sale. A short sale is profitable if the price. All you do is to phone your broker and put an order in saying that you wish to place your shares for sale at, for arguments sake, double today's price. As they. Short interest, stock short squeeze, short interest ratio & short selling data positions for NASDAQ, NYSE & AMEX stocks to find shorts in the stock market. There are two ways that a stock can be legitimately “shorted”. The first, used principally by institutional short sellers (eg hedge funds), is to borrow stock. With stocks, a long position means an investor has bought and owns shares of stock. · An investor with a short position has sold shares but does not possess them. For example, if Apple shares are trading at $ a share, and you short-sell , you could close your position when the price reaches $ a share and make a. To short means to sell a stock which you do not have. You short a stock when you expect the price of a stock to go down. For example, lets say. In practice, shorting is based on borrowing shares, selling them at the price of the day, in order to then buy them back (hopefully) cheaper, before they need. Schematic representation of naked short selling of stock shares in two steps. The short seller sells shares without owning them. They later purchase and deliver. The borrower benefits from the short sale, but the lender gets back that share at a lower value. Do they not care about the value, they just want the share. Find the latest on short interest, settlement dates, average share volume, and days to cover for Solowin Holdings Ordinary Share (SWIN) at wwwsimf.ru In order to short sell a stock, you need to be able to borrow shares to sell. Generally, this process happens behind the scenes and the process is facilitated. Short selling is a strategy that is used when an investor expects a share to fall in value. In practice, shorting is based on borrowing shares, selling them.

How Much Do You Put Down On Land

How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. Your Campus Housing Programs Representative or the Office of Loan Programs staff will be happy to answer any specific questions you may have. down payments. Government programs like USDA loans may provide land buyers with affordable interest rates and very little or no money down. Ready-to-build lots may be less. Your down payment can be as low as % of the purchase price. Available on unit properties. Financial help for seniors. Are you 62 or older? Do you live in. Most lenders will require % down for a land purchase when you are ready to build, you can roll your land loan into a construction loan . Land contracts can make property easier to sell because the seller decides the credit requirements and down payment amount. The parties can also negotiate the. Land equity is the value of your land minus any money you owe on the loan used to purchase it. With a land equity loan, you can turn that equity into cash. If your down payment is at least 20% of the property price, you typically How Much Should You Put Down? APR vs. Interest Rate · Prequalification vs. Mortgage Insurance: Private Mortgage Insurance (PMI) is usually required when you have a conventional loan and make a down payment of less than 20 percent of. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. Your Campus Housing Programs Representative or the Office of Loan Programs staff will be happy to answer any specific questions you may have. down payments. Government programs like USDA loans may provide land buyers with affordable interest rates and very little or no money down. Ready-to-build lots may be less. Your down payment can be as low as % of the purchase price. Available on unit properties. Financial help for seniors. Are you 62 or older? Do you live in. Most lenders will require % down for a land purchase when you are ready to build, you can roll your land loan into a construction loan . Land contracts can make property easier to sell because the seller decides the credit requirements and down payment amount. The parties can also negotiate the. Land equity is the value of your land minus any money you owe on the loan used to purchase it. With a land equity loan, you can turn that equity into cash. If your down payment is at least 20% of the property price, you typically How Much Should You Put Down? APR vs. Interest Rate · Prequalification vs. Mortgage Insurance: Private Mortgage Insurance (PMI) is usually required when you have a conventional loan and make a down payment of less than 20 percent of.

A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. You can use Zillow's down payment assistance page and questionnaire. down payments of 20% or more. A debt ratio of 36% is used for all down payments. The following ratios are used for aggressive results: housing and debt. A land purchase can't be leveraged with a bank the same way a home purchase can, so you'll likely have to pay cash if there's no structure on the property yet. How to Qualify for an Investment Property Mortgage. To qualify for an RBC Investment Property Mortgage, you must have a good credit history, demonstrate. Free down payment calculator to find the amount of upfront cash needed, down payment percentage, or an affordable home price based on 3 potential. Down payment minimum: 15% to 35%The Federal Deposit Insurance Corporation (FDIC) sets minimum down payment requirements for land loans, though individual. Mortgage Calculator · How much should I put down? · What your loan term means · ZIP code finder · Enter City and State to get a custom rate. When you're taking out a land loan, expect to put between 25 and 50 percent down. The difference depends on the policies of the lender, the piece of land in. Use GeoWarehouse to search for property information. Explore how GeoWarehouse can simplify you workflow with its tools and services. Financing to cover up to 20% down payment and up to 5% closing costs. Loan amounts up to $50, for homes located in High or Very High Opportunity Areas (per. Mortgage Type, Minimum Down Payment, Mortgage Payment ; FHA, % of Home Value $17, down payment, $2, monthly mortgage payment (Includes $ monthly. How much down payment do you need for an investment property loan? As a rule of thumb, buy-and-hold real estate investors normally make a down payment of. Use the farm or land loan calculator to determine monthly, quarterly, semiannual or annual loan payments. Get ag-friendly, farm loan rates and terms. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for. It also takes into account your planned mortgage payments. The amount of money you need for a down payment depends on factors like the loan type and your. Buying your first home? FHA might be just what you need. Your down payment can be as low as % of the purchase price. Available on unit. Mortgage Type, Minimum Down Payment, Mortgage Payment ; FHA, % of Home Value $17, down payment, $2, monthly mortgage payment (Includes $ monthly. Down Payment loan funds may be used only to partially finance the purchase of a family farm. Loan applicants must contribute a minimum down payment of 5 percent. Down Payment loan funds may be used only to partially finance the purchase of a family farm. Loan applicants must contribute a minimum down payment of 5 percent. If your total down payment is less than 20% of your home's purchase price, you may also have to pay private mortgage insurance or PMI at closing. You may also.

Change Check Into Cash

Cash checks for less · $4 maximum fee¹. For preprinted checks cashed up to $1, · Get cash in a flash. Bring your check & valid ID to a Walmart store. The firm offers payday loans, online payday advances, title loans, bill payment services, check cashing, reloadable prepaid debit cards, and Western Union. Your local Check Into Cash store offers a ton of available services that make it quick and easy to get the same-day emergency cash you need. Your bank and the payday lender will both charge you a fee. Some payday lenders might try to cash the check several times. Each time the check bounces, the bank. Ways of Converting Cheques into Money · Traditional Banking: Visit your bank and deposit the cheque into your account. · ATM Deposits: Many banks offer the. Check Into Cash. (1 review). Check Cashing/Pay-day Loans RODRIGOwent above and beyond to have my cash changed! I will be definitely. Welcome back, returning Check Into Cash customer! Here is your customer login portal. Select your state to log into your customer dashboard. Check Cashing · "We cash MOST checks at 3%" · Just bring your check and a photo ID (drivers license, Military ID, Passport, etc.) and we will turn your check into. 1. Bring gift cards to a nearby Check Into Cash store to see how much they're worth. 2. Show your driver's license. 3. Walk out with your cash in hand. Cash checks for less · $4 maximum fee¹. For preprinted checks cashed up to $1, · Get cash in a flash. Bring your check & valid ID to a Walmart store. The firm offers payday loans, online payday advances, title loans, bill payment services, check cashing, reloadable prepaid debit cards, and Western Union. Your local Check Into Cash store offers a ton of available services that make it quick and easy to get the same-day emergency cash you need. Your bank and the payday lender will both charge you a fee. Some payday lenders might try to cash the check several times. Each time the check bounces, the bank. Ways of Converting Cheques into Money · Traditional Banking: Visit your bank and deposit the cheque into your account. · ATM Deposits: Many banks offer the. Check Into Cash. (1 review). Check Cashing/Pay-day Loans RODRIGOwent above and beyond to have my cash changed! I will be definitely. Welcome back, returning Check Into Cash customer! Here is your customer login portal. Select your state to log into your customer dashboard. Check Cashing · "We cash MOST checks at 3%" · Just bring your check and a photo ID (drivers license, Military ID, Passport, etc.) and we will turn your check into. 1. Bring gift cards to a nearby Check Into Cash store to see how much they're worth. 2. Show your driver's license. 3. Walk out with your cash in hand.

Refinancing the loan rather than paying the debt in full when due will require the payment of additional charges. Check Into Cash engages in the money. Types of Checks you can Cash at Money Services · Payroll Checks · Government Checks · Income Tax Refund · Insurance Settlement · Business Checks · Debit Card Cashing. MOST banks will not have $k available immediately to cash a check, because most institutions only keep what they need to have on hand plus a. When signing over a check is not an option, consider using other, secure forms of payment. Remember, changing money requires care and attention to protect your. You can go to the bank that is on the check. They usually cash checks from their own wwwsimf.ru you don't have an account with them they may charge a 2% cashing. Scroll down, and under "More ways to add money," select "Checks." The Mobile Check Capture feature might not yet be available to you if you don't see this. It's easy to cash your checks at PLS. Cash your payroll, recurring government benefits and PLS money orders starting at the low rate of 1% + $1. Refinancing the loan rather than paying the debt in full when due will require the payment of additional charges. Check Into Cash engages in the money. We also cash money orders, traveler's checks, and out-of-state and international checks. Q: Is there a check amount that you won't cash? A: We can cash most. Banks are notorious for placing holds on checks. Check cashing places give you cash right away. No holds, no waiting. Learn what sets check cashing places. 1. Bring a valid photo ID to any branch of your bank. If you hold an open account of any type with a bank, they will cash a valid check for you. When cashing a check, it's often best to keep most or all of the sum in your checking account until you need cash, at which time you can withdraw as much as you. Most of our Check Into Cash stores offer Western Union® Money Transfer. You can purchase Money Orders and transfer money worldwide. Need to cash a check but don't have a bank account? Even if it's handwritten or out of state, you can get cash immediately with check cashing service. Whether you're looking to cash a check or searching for a loan, use our store locator to find the most convenient Check Into Cash location. At Check Into Cash, we are open after most banks close, so you can cash your paycheck at your convenience! wwwsimf.ru Rules and. There is no federal law or regulation that requires banks to cash checks for non-customers. Most banks have policies that allow check cashing services only for. Check Center cashes all types and amounts of checks. Call us at with any questions you may have about cashing a check. The easiest way to cash a check is to take it to a bank where you have an account. · Check-cashing services are found at Walmart and many grocery stores. · Checks. Check Into Cash is a licensed payday lender that specializes in emergency financing for people with bad credit. It offers payday loans as low as $