wwwsimf.ru

Learn

Should I Insure My Ring

Scheduled jewelry insurance normally costs around $1 to $2 per $ worth of jewelry per year. This means to insure $20, worth of jewelry could cost you $ So, depending on your insurer's rates, your $5, engagement ring could cost between $75 and $ per year to insure. It's up to you to weigh the expense. If you don't insure your engagement ring or jewelry by adding an insurance rider to your property insurance or getting a standalone jewelry insurance policy. Moreover, filing a claim for your ring could increase your insurance premiums or jeopardize your policy renewal. Therefore, a dedicated engagement ring. How do you insure valuable items? Your existing homeowners policy may include some coverage for jewelry and other valuable items. However, the coverage is. Jewelers Mutual is a personal jewelry insurer covering repair and replacement of engagement rings. Policies are not available for unset stones, damaged items or. Yes. You have the ring appraised by a jewelry appraiser, take the appraisal into your insurance agent and if the appraised value is higher than. Like most insurance policies, ring insurance requires you to pay a premium to get and keep coverage. Then, if something happens and you need to file a claim. Rates depend on where you live, but for most people, jewelry insurance will cost % of the value of your jewelry. For example, a $5, engagement ring could. Scheduled jewelry insurance normally costs around $1 to $2 per $ worth of jewelry per year. This means to insure $20, worth of jewelry could cost you $ So, depending on your insurer's rates, your $5, engagement ring could cost between $75 and $ per year to insure. It's up to you to weigh the expense. If you don't insure your engagement ring or jewelry by adding an insurance rider to your property insurance or getting a standalone jewelry insurance policy. Moreover, filing a claim for your ring could increase your insurance premiums or jeopardize your policy renewal. Therefore, a dedicated engagement ring. How do you insure valuable items? Your existing homeowners policy may include some coverage for jewelry and other valuable items. However, the coverage is. Jewelers Mutual is a personal jewelry insurer covering repair and replacement of engagement rings. Policies are not available for unset stones, damaged items or. Yes. You have the ring appraised by a jewelry appraiser, take the appraisal into your insurance agent and if the appraised value is higher than. Like most insurance policies, ring insurance requires you to pay a premium to get and keep coverage. Then, if something happens and you need to file a claim. Rates depend on where you live, but for most people, jewelry insurance will cost % of the value of your jewelry. For example, a $5, engagement ring could.

Should I Insure My Rings and Jewelry? · Your homeowner's or renter's insurance will not be adequate to safeguard your diamonds, gold and other good stuff. · You. With some policies, your engagement ring could already be covered on your house insurance if it is under a certain value. If your ring exceeds the value of your. Avoid wearing your ring when cleaning or doing other practical tasks to avoid losing it. If you are newly engaged or have been engaged for a while and are now. If you own a valuable piece or collection of jewelry, getting adequate coverage could be worth it. Your standard homeowners or renters policy is likely. Purchasing engagement ring insurance is a personal financial decision that only you can make. However, if you're upset at the mere thought of your engagement. An appraisal is the document stating the piece of jewelry's worth. The appraiser determines that worth through careful inspection of your jewelry's condition. Engagement ring insurance is an important policy for your engagement and wedding rings that helps cover the cost to repair or replace it in the event it's. So, an engagement ring valued at $5, could cost roughly $50 to $ a year, or $4 to $8 a month to insure. This leads to the next question: will your home. I lost my ring last year and we had it insured through Jewelers Mutual. They were fantastic (definitely worth the highest premium) but dropped us after I got my. Jewelry insurance can be worth it for the specialized service and coverage you get. It costs only a small fraction of the value of your jewelry, and you don't. At the time you purchase an engagement ring (even before you propose) you should get your ring insured right away. Your best engagement ring insurance policy. In , the average price of an engagement ring added to Lemonaders' policies was $10,, so you should go ahead and assume you'll need to add Extra Coverage. Almost all homeowner insurance policies are inadequate for fine jewelry and luxury watches that are valued at over $ Check to see exactly what your current. At what ring price should I insure my engagement ring? In general, we recommend engagement ring insurance if your ring costs $3, or more. Why? You want to. In general, jewelry insurance may cost between 1% to 2% of the value of your jewelry or valuable item. For example, a $5, engagement ring could cost as. You should consider insuring an engagement ring and other particularly valuable jewelry—whether due to its monetary or sentimental value. It's generally. For example, a $5, engagement ring could cost as little as $50 per year to insure. To put that in perspective, jewelry insurance can cost less than getting. Is it Worth it to Insure My Engagement Ring? · Your ring has a design that could be easily damaged · Your ring's value increases over time · You travel often or. Depending on where you live, the average cost to insure diamond jewelry is $1 to $2 for every $ in replacement costs. What Should You Do After You're Insured.

Extending Credit Card Limit

Sometimes your card issuer will offer to increase your credit limit after you've consistently demonstrated that you use the card responsibly. This includes. How can I change my supplementary credit card limit? You can change the limit of your supplementary credit card through Online Banking. You can track your. Key Takeaways Increasing your credit limit can lower your credit utilization ratio, potentially boosting your credit score. Website: Login to wwwsimf.ru and click on EMI & More tab on left hand side Chatbot ILA: Login to Chatbot ILA, ask query for Credit Limit increase and follow. To request an Apple Card credit limit increase, you can chat with an Apple Card Specialist at Goldman Sachs. Choose the credit card you'd like to request an increase on. · Online banking: Select Account services, then choose Request Credit Limit Increase. · Provide your. They include requesting a higher limit from your credit card's issuer, waiting for your credit card company to automatically raise your credit limit, adding to. It's possible to increase credit limit. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best. To potentially improve your odds of a credit limit increase, keep your account in good standing, pay your bills on time, and maintain a lower utilization rate. Sometimes your card issuer will offer to increase your credit limit after you've consistently demonstrated that you use the card responsibly. This includes. How can I change my supplementary credit card limit? You can change the limit of your supplementary credit card through Online Banking. You can track your. Key Takeaways Increasing your credit limit can lower your credit utilization ratio, potentially boosting your credit score. Website: Login to wwwsimf.ru and click on EMI & More tab on left hand side Chatbot ILA: Login to Chatbot ILA, ask query for Credit Limit increase and follow. To request an Apple Card credit limit increase, you can chat with an Apple Card Specialist at Goldman Sachs. Choose the credit card you'd like to request an increase on. · Online banking: Select Account services, then choose Request Credit Limit Increase. · Provide your. They include requesting a higher limit from your credit card's issuer, waiting for your credit card company to automatically raise your credit limit, adding to. It's possible to increase credit limit. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best. To potentially improve your odds of a credit limit increase, keep your account in good standing, pay your bills on time, and maintain a lower utilization rate.

A simple phone call to your credit card issuer will work. There are also some financial institutions that will let you submit a request online or through their. To request a credit limit increase · Log on to online banking. · Choose the relevant credit card from the account summary screen. · Select 'Manage' on the right. Other ways to accept your credit limit increase: Chat live with a Digital Messaging specialist* by clicking on the icon, or; By calling Whether you have a higher or lower credit limit, you should use your credit card responsibly. Don't spend more than you can afford to pay, pay off the whole. In many cases, the answer is simple — all you have to do is ask. Under the right circumstances, a credit limit increase could benefit your credit scores. Click 'Request change' under 'Current Card limits', and you can make your selection there. In case you're wondering, as part of the request for a credit limit. 6 Tips to Increase Your Credit Limit Today (Aug. ) · 1. Apply for a New Card with a Higher Credit Limit · 2. Pick an Existing Card to Request an Increase On. Submitting a request for a credit limit increase is typically very straightforward. The options include reaching out to your current credit card issuer either. To request an Apple Card credit limit increase, you can chat with an Apple Card Specialist at Goldman Sachs. Request for a credit limit increase You could make the request online or over the phone by calling the customer service number on the back of your card. Keep. Do you need access to a higher credit limit? Sign in your account to view your eligibility and request a credit limit increase. Sign on to Wells Fargo Online to see your credit card balance, add card services, and more. If you are not enrolled in Wells Fargo Online, enroll now. Go to the My USAA home page. Choose your credit card account. Select “My Account.” Select “Change Credit Limit.” If you want to change your. A simple phone call to your credit card issuer will work. There are also some financial institutions that will let you submit a request online or through their. You can request a credit limit increase online through Digital Banking. Your best potential for growth of your Capital One limit is by reporting the highest statement balances possible, then paying them off in full. Ways to increase credit limit with ICICI · active tab normal tab icon SMS · active icon IMOBILE PAY APP · Internet Banking · active tab icon normal tab icon. Request a credit limit increase through your online bank. Contact us to request a credit limit decrease. Need to make a cash advance or balance transfer? Your. Receiving a credit limit increase lowers your credit utilization ratio and will help your overall credit score over the long term. Go to the My USAA home page. Choose your credit card account. Select “My Account.” Select “Change Credit Limit.” If you want to change your.

Sofi Loan Process

You can apply for a SoFi loan online or through its iOS or Android mobile app. You can start the application process by applying to prequalify — which usually. How does SoFi manage to offer such competitive rates and fees? The answer lies in their advanced technology and efficient processes. By leveraging cutting-edge. A beginner's guide to personal loans. Learn how they work, common uses, how to qualify, and how to afford payments with SoFi. During their prequalification process of checking rates for student loans, SoFi will perform a soft credit check, which will not hurt your credit score. However. On average the approval time frame is about business days and funded the next business day after you have signed your loan. SoFi loans for students have a borrowing minimum of $1, There is no maximum limit for a SoFi Private Student Loan. Q: Who is eligible for a SoFi Private. Additionally, SoFi has an A+ rating from the Better Business Bureau, though it is not a BBB-accredited business. You can reach a representative in the personal. To apply for a loan from SoFi, you'll need to fill out an online application. The application will ask for basic information about you and your financial. While both options can lead you to securing a personal loan, the process and even the fees and rates can differ for an online loan application vs. in-person. You can apply for a SoFi loan online or through its iOS or Android mobile app. You can start the application process by applying to prequalify — which usually. How does SoFi manage to offer such competitive rates and fees? The answer lies in their advanced technology and efficient processes. By leveraging cutting-edge. A beginner's guide to personal loans. Learn how they work, common uses, how to qualify, and how to afford payments with SoFi. During their prequalification process of checking rates for student loans, SoFi will perform a soft credit check, which will not hurt your credit score. However. On average the approval time frame is about business days and funded the next business day after you have signed your loan. SoFi loans for students have a borrowing minimum of $1, There is no maximum limit for a SoFi Private Student Loan. Q: Who is eligible for a SoFi Private. Additionally, SoFi has an A+ rating from the Better Business Bureau, though it is not a BBB-accredited business. You can reach a representative in the personal. To apply for a loan from SoFi, you'll need to fill out an online application. The application will ask for basic information about you and your financial. While both options can lead you to securing a personal loan, the process and even the fees and rates can differ for an online loan application vs. in-person.

SoFi offers personal loans of $ to $, with terms from two to seven years. Learn how to get a SoFi loan, and how it compares to other lenders. Note that it can take up to two business days for SoFi to process individual personal loan applications. Get your funds. If you're approved and want to proceed. Developing a loan app like SoFi begins with thorough market research and business planning. Identifying target market segments and understanding their specific. 1. Credit Score · 2. Collateral · 3. Proof of Income and Employment · 4. Debt-to-Income Ratio · 5. Origination Fee · How to Qualify for a Personal Loan · Applying for. Easily apply for a personal loan online in 3 steps. Prequalify Find the rate that you qualify for in 60 seconds with no commitment. Easily apply for a personal loan online in 3 steps. · Prequalify. Find the rate that you qualify for in 60 seconds with no commitment. · Choose your loan terms. Yes, SoFi (Social Finance) does allow borrowers to have more than one loan at a time. However, eligibility for multiple loans depends on. No origination or signup fee: None of the lenders on our best-of list charge borrowers an upfront fee for processing your loan. Fixed-rate APR: Variable rates. 1. Credit Score A key factor lenders consider when considering whether to approve applications for personal loans is the applicant's credit score. To apply for a student loan with SoFi, you'll fill out an application on its website, asking for personal information and details on the schools and programs. Loan approval and loan funding from SoFi Once you submit your application materials, you might want to ask a SoFi loan consultant how long the process might. SoFi's loan application process is seamless, quick, and simple. You'll complete an online application that can be done from your desktop, phone, or tablet. In. Underwriters protect a bank, credit union, or mortgage company by making sure that they only give loan approval to aspiring homeowners who have a good chance. How Long Does It Take SoFi to Approve a Loan? In most cases, funds should be available within a few days of your SoFi approval. To help expedite the process. Typically, an applicant must have a FICO score or higher to qualify. They must also have a certain income, though this depends on the loan amount and other. Get Pre-qualified: SoFi offers an online application for pre-qualification, which allows you to check your rates and loan terms without hurting your credit. You can apply for a SoFi student loan online within minutes and may receive an approval decision right away. Once your loan has been approved, SoFi will verify. Loan processor was absolutely AWFUL to deal with and made me never want to to deal with Sofi in any capacity. Had to submit the same documents numerous times. What is the estimated funding time for a personal loan via Sofi loans? Sofi loans will typically approve (or deny) a loan application within 1 hour and fund. SoFi lets you check if you qualify and what rates you are likely to get. You'll answer simple questions about your income, fill in some personal info—and voilà!

Apple Credit Card Build Credit

The newly introduced Apple Card Family tool gives Apple Card users a way to teach the whole family how to build credit and manage a budget. Apple Card is a rewards-based credit card that gives consumers cash back on various categories of purchases. Because Apple pushes the card as part of its. If you're 18 years or older, you can opt in to build your credit history while you're part of a shared Apple Card account. Apple Card can help you build credit with responsible use. The card reports to all three of the national credit bureaus. Easy cash back redemption. The Apple. on travel purchases and mobile wallet spending on Apple Pay®, Google Wallet and Samsung Pay. Over time, this will help build your credit and you may be able. You can share your Apple Card account with up to five people, which may be helpful if you have teenagers and others who need to build credit. Who is the. It allows two partners to merge credit lines to form a single co-owned account, manage that account together, and build credit as equals. Helped me securely build credit. The service at AFCU is great! + Pros: Good I recently applied for an Apple Federal Credit Card. I was very please. Apple Card Family allows two partners to merge credit lines to form a single co-owned account, manage that account together, and build credit as equals. The newly introduced Apple Card Family tool gives Apple Card users a way to teach the whole family how to build credit and manage a budget. Apple Card is a rewards-based credit card that gives consumers cash back on various categories of purchases. Because Apple pushes the card as part of its. If you're 18 years or older, you can opt in to build your credit history while you're part of a shared Apple Card account. Apple Card can help you build credit with responsible use. The card reports to all three of the national credit bureaus. Easy cash back redemption. The Apple. on travel purchases and mobile wallet spending on Apple Pay®, Google Wallet and Samsung Pay. Over time, this will help build your credit and you may be able. You can share your Apple Card account with up to five people, which may be helpful if you have teenagers and others who need to build credit. Who is the. It allows two partners to merge credit lines to form a single co-owned account, manage that account together, and build credit as equals. Helped me securely build credit. The service at AFCU is great! + Pros: Good I recently applied for an Apple Federal Credit Card. I was very please. Apple Card Family allows two partners to merge credit lines to form a single co-owned account, manage that account together, and build credit as equals.

Credit Karma said my approval chances were poor, even though my credit score is and I have good income. I applied for the card and got the card no. Key Takeaways · Competitive APRs. Apple FCU Visa Credit Builder Credit Card has a variable purchase APR that ranges from 15% up to 18%. · No annual fee. This is a. Establish, strengthen or build your credit – use this card responsibly and over time it can improve your overall credit score. The PNC Secured Visa credit card. Most recently, Apple has rolled out Apple Card Family, which lets people share an Apple Card and build their credit together. This guide explains everything you. Adding one or more participants to your Apple Card account may lead to higher credit utilization, because multiple people can now spend on the same account. Can having multiple credit cards build or hurt your credit score? The Apple Card is a MasterCard credit card and is treated no. If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. If you accept your offer, a. I recently applied for an Apple Federal Credit Card. I was very please with the process of getting approved. I appreciated how easy it was, the questions. Use your Ava Credit Builder Card to pay subscriptions and bills you're already paying for, with no interest and no additional card fees, ever. You can share your credit line with a co-owner and build credit together as equals. You can even invite another Apple Card owner to combine credit limits with. Make all of your required payments on time · Lower your credit card and personal loan debt · Resolve your past-due balances. Make the most of everyday purchases. Build credit*, and earn reward points* on every purchase. No credit checks, no hidden fees, and no interest rates. There are several reasons why you might want more credit. Here's how you can request an Apple Card credit limit increase and what you need to do to qualify. Apple Bank in NY offers a variety of Visa credit cards, each with many benefits Secured Visa® Card. Establish or Improve Your Credit. Request your own. A simpler, smarter credit card. Whether you buy things with Apple Pay or with the laser-etched titanium card, Apple Card can do lots of things no other credit. Build credit Fast by 44 points with the Grow Debit Mastercard - pay for your subscriptions and cell phone plan! Apple Card is the credit card designed by Apple and backed by Goldman Sachs credit cards and build credit together.” Apple Card customers can add up to. Start with a Credit Builder Account* that reports to all 3 credit bureaus. Each on-time monthly payment builds credit history and savings. Choose the plan that. Make the most of everyday purchases. Build credit*, and earn reward points* on every purchase. No credit checks, no hidden fees, and no interest rates.

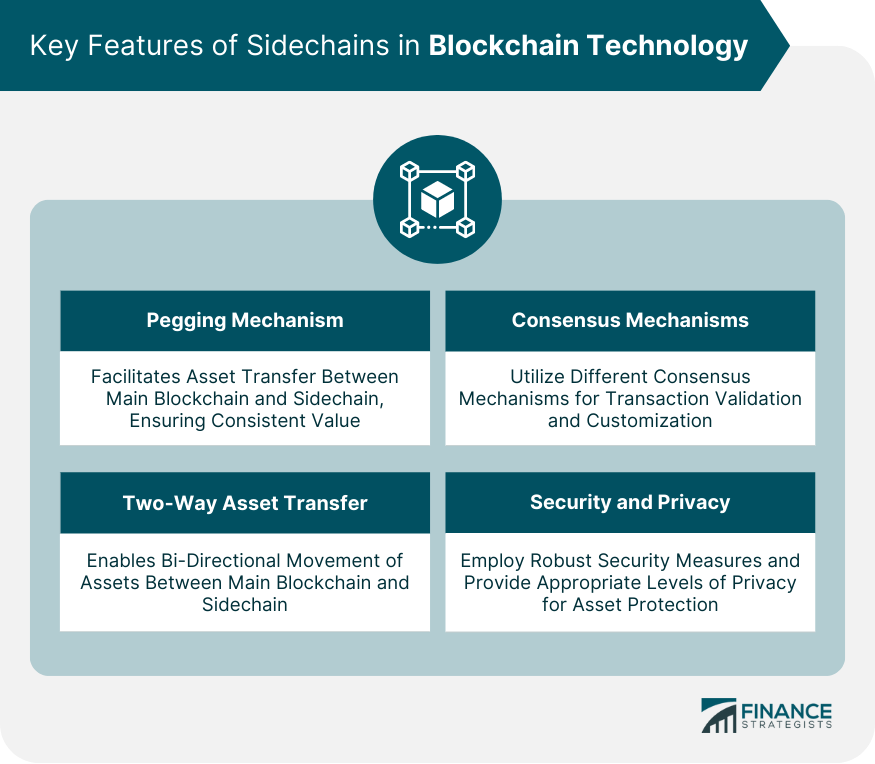

Sidechain Blockchain

Sidechains provide an experimental playground for developers to test new ideas, features, and consensus mechanisms without affecting the stability or security. A sidechain is a separate blockchain which runs in parallel to Ethereum and operates independently. It has its own consensus [ ]. Sidechain is a separate blockchain that acts as an extension to the parent blockchain, often referred to as the mainchain. To create a sidechain it is necessary. Sidechains (also called two-way pegged sidechains) are block chains whose native unit of currency is the same as another block chain. Blockchain empowers consumers by allowing them to access detailed information about the products they purchase. With a simple scan of a QR code, consumers can. Uncover the role of sidechains, Layer 2 blockchain solutions that offer scalability, flexibility, and enhanced functionality to main chains. A sidechain is a transactional chain that runs alongside a blockchain and is generally used for big bulk transactions. Sidechains make use of a different. Side chain or sidechain, that's the name of one of the recent developments that seek to take blockchain technology to a new level. Elements is an open source, sidechain-capable blockchain platform, providing access to powerful features such as Confidential Transactions and Issued. Sidechains provide an experimental playground for developers to test new ideas, features, and consensus mechanisms without affecting the stability or security. A sidechain is a separate blockchain which runs in parallel to Ethereum and operates independently. It has its own consensus [ ]. Sidechain is a separate blockchain that acts as an extension to the parent blockchain, often referred to as the mainchain. To create a sidechain it is necessary. Sidechains (also called two-way pegged sidechains) are block chains whose native unit of currency is the same as another block chain. Blockchain empowers consumers by allowing them to access detailed information about the products they purchase. With a simple scan of a QR code, consumers can. Uncover the role of sidechains, Layer 2 blockchain solutions that offer scalability, flexibility, and enhanced functionality to main chains. A sidechain is a transactional chain that runs alongside a blockchain and is generally used for big bulk transactions. Sidechains make use of a different. Side chain or sidechain, that's the name of one of the recent developments that seek to take blockchain technology to a new level. Elements is an open source, sidechain-capable blockchain platform, providing access to powerful features such as Confidential Transactions and Issued.

Discover 4 Sidechains across the most popular web3 ecosystems with Alchemy's Dapp Store. Also explore related collections including Layer 1 Blockchains. A sidechain is a separate blockchain that is linked to a main blockchain, allowing for the transfer of digital assets between the two chains. Sidechains are secondary blockchains linked to a primary blockchain (mainchain). They enable asset transfers between the mainchain and sidechain, offering. Seamlessly run your sidechain and scale your blockchain applications, catering to gaming startups and enterprise needs. Unlock the potential of blockchain. A sidechain can be described as a blockchain that can interact with another blockchain. There are two basic types of sidechains. A blockchain network that runs parallel to and interacts with the main blockchain. For example, Rootstock and Stacks are Bitcoin sidechains. Elements code tutorial. Elements as a Sidechain - Federated Two-Way Peg. Elements is a general purpose blockchain platform that can also be “pegged” to an. A Bitcoin sidechain is an independent blockchain that can securely transfer bitcoins internally and from/to the Bitcoin network without supporting a money. Sidechain technology complements blockchain. Sidechains improve blockchain functionality by performing operations outside of blockchains and delivering the. Each sidechain is a full-fledged blockchain with its own rules, algorithms, users, methods of receiving rewards, protection mechanisms, and other basic. By operating alongside the mainchain, sidechains offer a way to extend and enhance the functionality of blockchain technology. They are designed to address. Since sidechains are usually independent blockchains, their security can potentially be compromised since they are not secured by the main chain. On the other. Sidechains are basically up-and-coming mechanisms that permit tokens and other digital resources from one blockchain to be firmly used in a separate blockchain. Sidechains are separate blockchains that are interoperable with a main blockchain, allowing assets and data to be transferred between them. They work by using a. Side-chaining, an effect in digital audio processing; Sidechain (ledger), a designation for a particular blockchain; "Sidechain", a song by Knuckle Puck from. A sidechain is linked to the main blockchain, known as the mainnet or parent chain, using a two-way peg. BLOCKCHAINCONSENSUSPROOF-OF-WORKSIDECHAINS. During the last decade, the blockchain space has exploded with a plethora of new cryptocurrencies, covering a. First applied mainly to Bitcoin, the sidechain concept was basically to run another blockchain alongside some other “main” blockchain. These two blockchains. Each sidechain is a full-fledged blockchain with its own rules, algorithms, users, methods of receiving rewards, protection mechanisms, and other basic. Sidechain is a method of separation blockchains. Instead of using only primary blockchain, a user now can transfer his digital assets to a supplemented one.

Make More Money At Home

Get paid for services that do not require an internet connection, such as dog walking, lawn mowing, house sitting, home organization, car repair, handyman. REITs allow individuals to invest in large-scale, income-producing real estate. You can earn a share of the income produced without buying, managing, or. 1. Rent out rooms in your home · 3. Become an online tutor · 4. Rent out your car · 5. Start a freelance business · 6. Pet sitting at your home · 8. Sell web domain. A smoothly running blog can make you earn money when you aren't actively doing anything! For a blog to generate income, you can display ads, be involved in. Check out mobile apps like Ibotta, Rakuten, Shopkick, Receipt Hog and Dosh to score some extra cash without too much work on your part. 5. Teach English. It's. How much can you make: Bloggers make $1, to $, a month. Blogs are one of the most popular ways to make money because they required little upfront costs. If you don't know what to put for the job, put customer service. You can get your foot in the door at a lot of companies doing customer service. In this article, I share 30 ways you can start making money from home, TODAY. You can use these ideas whether you want to make some quick extra cash or move. While it might sound strange, these market research surveys are a known way to make extra cash online. Of course, they won't make you rich but if you have. Get paid for services that do not require an internet connection, such as dog walking, lawn mowing, house sitting, home organization, car repair, handyman. REITs allow individuals to invest in large-scale, income-producing real estate. You can earn a share of the income produced without buying, managing, or. 1. Rent out rooms in your home · 3. Become an online tutor · 4. Rent out your car · 5. Start a freelance business · 6. Pet sitting at your home · 8. Sell web domain. A smoothly running blog can make you earn money when you aren't actively doing anything! For a blog to generate income, you can display ads, be involved in. Check out mobile apps like Ibotta, Rakuten, Shopkick, Receipt Hog and Dosh to score some extra cash without too much work on your part. 5. Teach English. It's. How much can you make: Bloggers make $1, to $, a month. Blogs are one of the most popular ways to make money because they required little upfront costs. If you don't know what to put for the job, put customer service. You can get your foot in the door at a lot of companies doing customer service. In this article, I share 30 ways you can start making money from home, TODAY. You can use these ideas whether you want to make some quick extra cash or move. While it might sound strange, these market research surveys are a known way to make extra cash online. Of course, they won't make you rich but if you have.

How much can I make? Caitlin Pyle made $43, in a year working part-time! You can see her full story in my How to Become a Proofreader article. Many others. Ways to Make Money From Your Unused Space · 1. Bring on a Housemate · 2. Rent a Room on Airbnb · 3. Rent Out Your Entire Home While Not Using It · 4. Create an ADU. You can make money online with a blog, selling on Amazon, or even by watching videos. The choices for side gigs are endless and many can be quite lucrative. Helping a pooch get some exercise and/or looking after them is a great way to make some extra cash – especially if you're responsible for more than one. 20 Ways to Make Money from Home in Making money from home doesn't have to be complicated. Check out these 20 smart ways to make cash from the comfort of. Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Explore areas like content creation. A smoothly running blog can make you earn money when you aren't actively doing anything! For a blog to generate income, you can display ads, be involved in. 2. Answer surveys – Survey companies I recommend as one of the ways to make extra money online include Swagbucks, American Consumer Opinion, Survey Junkie. Online surveys can be a great way to earn money from home. Survey sites offer opportunities for people to earn cash or rewards by taking surveys. Here are some. Makes for a little spending money and helps pay down my debt. I sometimes board dogs at my house, other times I'll sleep at the client's house. Then, earn extra cash by selling your creations on an online marketplace like Etsy. In the creative field, you can make money not only as a crafter of excellent. Want To Make Extra Income Online: Legitimate Ways To Earn Money Online From Home: Real Ways To Make Money From Home: Tijerino, Logan: Books. Drop Shipping is a cost-effective way to earn money online. You pay for no inventory up front and it is super easy to upload and fulfill orders with the Oberlo. Platforms like UserTesting will link you up with companies who need website testers, and you'll earn money for each test you do, typically $10/hr or more. How to Make Money at Home: 14 Easy Ways to Start a Side Hustle Online · Dropshipping · Publish an eBook · Start affiliate marketing · Start Blogging · Sell digital. Small business owners have a lot of administrative and miscellaneous needs that aren't worth paying the rates of specialized contractors like writers or. Become a Freelance Writer. Another way to make money from home is to write online. There are a lot of work opportunities for freelance writers on the net. Many. These videos share lots of ideas for anyone to earn an income from home. Most of them are online so you can work according to your own schedule. You can get more gigs from word-of-mouth referrals or if you want to boost your reach, sign up for wwwsimf.ru Their site states the going rate for one kid per. With a little creativity — and some clicking — anyone can log online and make extra money from home. And many of these gigs don't even require a business.

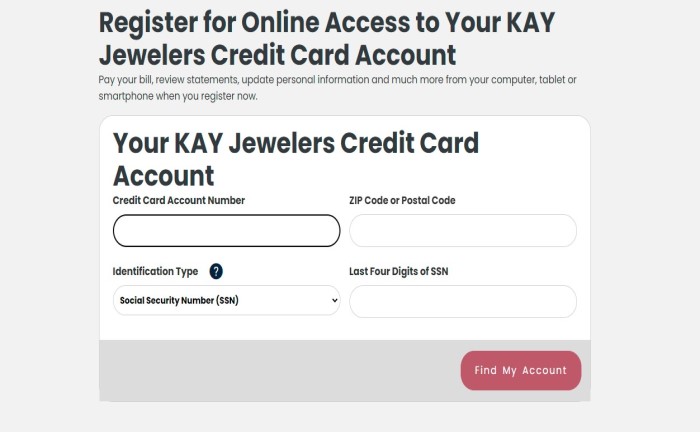

Manage Kay Card

✨ Manage your account with ease and enjoy exclusive benefits with the Kay Jeweler Credit Card Login #kaycreditcard. Key Cashback® Credit Card. up to 2% cashback on % of your purchases Red How to Manage Debt as a Couple When Only Your Partner Has Debt. SAVING. Manage Your KAY Outlet Credit Account | Kay Outlet. Home · Favorites. Sign KAY Jewelers Credit Card Learn More/Apply NowPay Bill/Manage AccountRegister Card. Managing partner, marketing specialist and Creative at Resonance Cards · I manage Resonance Cards, my small business that has a bigger mission than your. To pay or manage your card account, choose your card to begin. Kay Jewelers Comenity Issued Credit Card For Comenity Bank Cardholders We help them create and manage a consumer credit portfolio. There are two businesses that we specialize in: 1. General Purpose Credit Cards (GPCC), commonly. Choose the payment options to fit your budget from Kay today. If it appeared as a hard inquiry he talked to management and I believe they removed it. I used to work in furniture sales—but I would've been. Save time during checkout · Manage your wish list · Access your order history · Unlock higher tiers and more benefits with qualified purchases. ✨ Manage your account with ease and enjoy exclusive benefits with the Kay Jeweler Credit Card Login #kaycreditcard. Key Cashback® Credit Card. up to 2% cashback on % of your purchases Red How to Manage Debt as a Couple When Only Your Partner Has Debt. SAVING. Manage Your KAY Outlet Credit Account | Kay Outlet. Home · Favorites. Sign KAY Jewelers Credit Card Learn More/Apply NowPay Bill/Manage AccountRegister Card. Managing partner, marketing specialist and Creative at Resonance Cards · I manage Resonance Cards, my small business that has a bigger mission than your. To pay or manage your card account, choose your card to begin. Kay Jewelers Comenity Issued Credit Card For Comenity Bank Cardholders We help them create and manage a consumer credit portfolio. There are two businesses that we specialize in: 1. General Purpose Credit Cards (GPCC), commonly. Choose the payment options to fit your budget from Kay today. If it appeared as a hard inquiry he talked to management and I believe they removed it. I used to work in furniture sales—but I would've been. Save time during checkout · Manage your wish list · Access your order history · Unlock higher tiers and more benefits with qualified purchases.

Find your credit card account quickly to sign in. Then, you can manage your account online or learn more about your card's benefits today Continue to Kay. Unlimited Fast Pass Maintenance. Make changes to your account online: Update Credit Card Cancel Membership. Frequently Asked Questions. We're here to help you manage your money today and tomorrow. Checking Accounts. Choose the checking account that works best for you. See our Chase Total. Register on our Customer Portal to: View and print your Washington Gas bill on demand (up to 12 months); Pay your bill using your credit/debit card or. Our KAY credit cards allow for flexible financing options on any purchase. Get pre-qualified for your KAY credit card today! Welcome to Account Center. Sign in to manage your account. New here? Visit navigation to register for online access or to use EasyPay. Manage all your bills, get payment due date reminders and schedule automatic doxo processes payments for all Kay Jewelers services, including Credit Card and. KAY Jewelers Credit Card Learn More/Apply NowPay Bill/Manage AccountRegister Card · Lease Purchase Program Learn MoreApply Now · Affirm Learn More · Compare. manage your Kay account”. If the card statement and the actual card I work for comenity bank and yea we handle so many clients and it's so. like with the Banter Credit Card. Apply Now. Pay Account · Manage Account. YOU'VE GOT OPTIONS. Promotional Plan Options with the. Banter Credit Card. 6 Month. FNBO provides tools for you to manage your credit card including online services, a mobile app, paperless statements, alerts, digital payments, and more. Manage your Jewelers Reserve credit card account online, any time, using any device. Submit an application for a Jewelers Reserve credit card now. Manage your Jared Credit Card with Comenity Bank or Genesis Bank. Pay you bill or manage your credit account now. Chase Online is everything you need to manage your Credit Card Account. Wherever you travel you'll always know what's going on with your account – quickly. Protect your jewelry for life with a one-time payment. Learn More. KAY Jewelers Credit Card. Pay your statement online and manage your account with ease. FNBO offers personal and business credit card services, online banking, mobile banking, digital payments and more Manage your account online to check balances. See all of your accounts serviced by Concora Credit with one login. Manage your account with the Concora Credit App. With the app, you can activate your. KAY credit card. Kay Jewelers Credit Card - Home. Manage Your KAY Outlet Credit Account. Kay Jewelers Credit Card Review a Kay Jewelers Credit Card. KAY CREDIT. Manage your Credit Card Account · Get Prequalified · Progressive Leasing. PROMOTIONS. Coupons, Offers and Deals · View Kay Catalog · KAY Outlet. Simple to fund and manage. Compare CDs More details. Explore more cards Kay Jewelers Credit Card at Kay Jewelers. 1Minimum payments are required for.

Which Extended Auto Warranty Is The Best

Henna Chevrolet LP · United Auto Care · National Protection Service · Dean Sansone & Associates · Vanguard Dealer Services. Which vehicles come with the best warranty in Canada? Mitsubishi offers the best length of vehicle warranty, with Kia and Hyundai close behind. Mitsubishi. Some of the largest car warranty providers are CarShield, Autopom!, Protect my Car, Infinite Auto Protection, Carchex and Endurance. You can also purchase. Extended warranties are great for people who want to be prepared for possible repairs that may be needed once the factory warranty expires. If you're looking for an extended warranty beyond what a factory warranty will offer, there are two companies you may wish to consider. Endurance is ranked as. Is there a waiting period before the extended auto warranty goes into effect, for example, 30 days and 1, miles? It's important to note the “and” in the. Endurance, Carchex, Olive, CarShield, and Omega Auto Care are the best extended car warranties based on our analysis of cost, coverage, and more. The 13 New Car Brands With the Best Warranty Coverage · Types of New Car Warranties · 13) Acura · 12) Cadillac · 11) Lexus · 10) Lincoln · 9) Lucid Motors · 8) Tesla. list of most successful US companies, is certified by the Vehicle Protection Association, and has an A+ from credit rating agency AM Best. The direct. Henna Chevrolet LP · United Auto Care · National Protection Service · Dean Sansone & Associates · Vanguard Dealer Services. Which vehicles come with the best warranty in Canada? Mitsubishi offers the best length of vehicle warranty, with Kia and Hyundai close behind. Mitsubishi. Some of the largest car warranty providers are CarShield, Autopom!, Protect my Car, Infinite Auto Protection, Carchex and Endurance. You can also purchase. Extended warranties are great for people who want to be prepared for possible repairs that may be needed once the factory warranty expires. If you're looking for an extended warranty beyond what a factory warranty will offer, there are two companies you may wish to consider. Endurance is ranked as. Is there a waiting period before the extended auto warranty goes into effect, for example, 30 days and 1, miles? It's important to note the “and” in the. Endurance, Carchex, Olive, CarShield, and Omega Auto Care are the best extended car warranties based on our analysis of cost, coverage, and more. The 13 New Car Brands With the Best Warranty Coverage · Types of New Car Warranties · 13) Acura · 12) Cadillac · 11) Lexus · 10) Lincoln · 9) Lucid Motors · 8) Tesla. list of most successful US companies, is certified by the Vehicle Protection Association, and has an A+ from credit rating agency AM Best. The direct.

The good news is that your auto dealership will allow you to negotiate the price of the factory warranty plan. The dealership makes anywhere from $ to $ To learn about our full range of new and certified pre-owned Toyota extended warranties, contact Sterling McCall Toyota Fort Bend. One of our Richmond Toyota. Top 10 Best Extended Auto Warranty Companies · 1 Endurance Endurance is a well-known provider of vehicle service contracts, offering comprehensive coverage. An extended car warranty is also known as a vehicle service contract (VSC). A VSC does not extend the coverage of the original factory warranty, which is. The Best Extended Car Warranty Companies · Carchex · autopom! · Endurance · Toco Warranty · Omega Auto Care · Infinite Auto Protection · Concord Auto Protect. Protection plans from “American dream Auto Protect” reduce your high vehicle repair costs. Relax your mind and save high costs on car repairs from an. † A powertrain warranty typically lasts longer than your basic limited warranty, but covers fewer parts of your car (engine, transmission, and drive axles). CARCHEX is one of the largest providers of Extended Auto Warranty coverage. Latest Auto Warranty ArticlesView All Auto Warranty Articles. FlexCare is our new global brand for service contracts, extended warranties and other vehicle protection products. Whether you purchased FlexCare or Mopar. If you prefer to avoid surprises related to unexpected auto repair costs, then an extended warranty is probably a good choice. We can help you buy, maintain and. Find out the best vehicle extended warranty for your new and used vehicles. Reduce your repairs costs and save your time with the best car extended. best way to prepare for that? What About an Extended Auto Warranty? Car warranty companies make a lot of money from the sale of their extended warranty products. After getting quotes from the best car warranty companies, we found that extended warranties cost an average of $ per month with a total average cost of. An extended car warranty extends the standard manufacturer's warranty. Find A vehicle protection plan may be a better option. What's the difference. ConsumerVoice has researched and compared the top extended auto warranty providers so you can shop with confidence. Why choose one of olive's extended car warranty solutions to cover your car against high vehicle repair costs? · No waiting period-quote today and get covered. According to Consumer Reports, cars become less reliable over time, so you may feel better knowing that repair costs are covered. However, it's important you. vehicle repair costs after your New Vehicle Limited Warranty has expired. vehicle is kept overnight for an Extended Service Plan-covered repair. The 8 Best Extended Car Warranty Companies · Complete Car · Concord Auto Protect · Endurance · Carchex · Infinite Auto Protection · Olive · ASC Warranty · Protect My. An extended car warranty or vehicle service contract is an excellent way to protect yourself from high car repair costs. American Automotive Service Solutions.

Checking Account With No Startup Fee

Members of the military (requires self-disclosure) and clients ages 24 and under and those 65 and over pay no monthly maintenance fee. Return to content. Synovus Budget Checking7 is a "no frills, no surprises" account. $5 monthly account fee with a $25 minimum deposit to open. Budget Checking helps you carefully. Free checking account. · Enjoy unlimited check writing. · 24/7 mobile and online banking. · Earn your paycheck up to two days early, without a fee, with Early Pay. If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum balance requirement and a bonus opportunity. Check. With no monthly service fees or overdraft fees, you'll have more money to invest. Travel with confidence. No foreign transaction fees. Small Business Free Checking: Straightforward and hard-working, Small Business Free Checking has no minimum balance or monthly service fees. Perfect for. Early direct deposit—with direct deposit, get your money up to two business days early · No Chase fee at non-Chase ATMs · No Chase fees for checks · Earns interest. Its basic business checking account has no monthly maintenance fee, no minimum balance or deposit requirement, no foreign transaction fees and no fees at. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. Members of the military (requires self-disclosure) and clients ages 24 and under and those 65 and over pay no monthly maintenance fee. Return to content. Synovus Budget Checking7 is a "no frills, no surprises" account. $5 monthly account fee with a $25 minimum deposit to open. Budget Checking helps you carefully. Free checking account. · Enjoy unlimited check writing. · 24/7 mobile and online banking. · Earn your paycheck up to two days early, without a fee, with Early Pay. If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum balance requirement and a bonus opportunity. Check. With no monthly service fees or overdraft fees, you'll have more money to invest. Travel with confidence. No foreign transaction fees. Small Business Free Checking: Straightforward and hard-working, Small Business Free Checking has no minimum balance or monthly service fees. Perfect for. Early direct deposit—with direct deposit, get your money up to two business days early · No Chase fee at non-Chase ATMs · No Chase fees for checks · Earns interest. Its basic business checking account has no monthly maintenance fee, no minimum balance or deposit requirement, no foreign transaction fees and no fees at. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or.

charge no more than three overdraft fees per business day. Overdraft fees are not applicable to Clear Access Banking accounts. The payment of transactions. charge no more than three overdraft fees per business day. Overdraft fees are not applicable to Clear Access Banking accounts. The payment of transactions. rate subject to change without notice after account opening. 4 Interest Checking accounts will have a $20 maintenance service charge imposed if $5, in. MyWay Banking from M&T Bank®. Great for Starting Out. No overdraft fees. The Truist Simple Business Checking account is straightforward, with no monthly maintenance fee. Perfect if you're just getting started with your business. A supported mobile device is needed to use Mobile Banking. Standard message and data rates may apply. Virtual Wallet Student has no minimum balance requirement. When you open a bank account with Capital One it means no waiting in line for account access, plus great rates and zero fees - all in one place. Simple Checking is just that—simple: features you expect from a checking account, without a monthly fee. KEY BENEFITS • 55,+ fee-free ATMs worldwide • No. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. USAA Classic Checking account. Apply today with as little as $25 to enjoy these benefits with no monthly service fees. Avoid ATM Fees. An account designed for customers who don't write checks and want help managing their money without getting charged overdraft fees. Searching for a bank with free checking? SCCU offers a % free checking account with no hidden fees or transaction requirements. Open your account online. One extra Business Advantage Relationship Banking account and one Business Advantage Savings account can be included for no monthly fee · No fees for incoming. Check with your carrier for specific fees and charges. Please be advised that the alerts may not be sent immediately. Deposit products are offered by U.S. Bank. There's a $50 startup fee, but no monthly fees, no mobile check deposit fees, and no minimum balances to worry about. They charge a $27 overdraft fee, but. Citizens Quest® Checking · Get extra time to cover overdrafts with Citizens Peace of Mind® · No fees on overdraft plans · No overdraft charged on a first. Open an online checking account with cashback debit today. Earn cash back, enjoy no fees, and experience the freedom of a free checking account. Checking Account · Banking with Acorns · Banking for the growth-minded · No hidden fees - No hidden fees - No hidden fees - No hidden fees - No hidden fees - No. Free of the usual account fees ; Square sales instantly funded, Yes; free, Not offered ; Monthly service or maintenance fees, $0, $$16 per month or min. Find out how much you must keep in the account at all times to avoid or reduce fees. This is called the “minimum balance requirement.” This may not be the same.

Jp Morgan Chase Money Market

The investment objective of JPMorgan Liquid Assets Money Market Fund is to maximize current income consistent with the preservation of capital and same-day. If you are a shareholder who is no longer permitted to own a. Retail money market fund, your holdings will be involuntarily redeemed by the fund or "Chase Bank. Clients with investment accounts serviced by a JP Morgan Advisor can earn a return on available cash balances by choosing to automatically sweep these balances. Define JPMorgan Chase Money Market Account. means an interest bearing account at JPMorgan Chase Bank, N.A. jpmorgan. @jpmorgan. K subscribers•K videos. J.P. Morgan is a leader in financial Surprises and a Look Ahead | Market Matters | J.P. Morgan. The investment seeks current income while seeking to maintain liquidity and a low volatility of principal. The fund invests in high quality, short-term money. Chase Bank refer a friend for checking accounts. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus. About. JPMorgan Prime Money Market Fund. 6 | J.P. MORGAN MONEY MARKET FUNDS. Page 9 (JPMorgan Chase), a bank holding company. JPMIM is located at Madison. The Fund will comply with SEC rules applicable to all money market funds, including Rule 2a-7 under the Investment Company Act of Portfolio Managers. The investment objective of JPMorgan Liquid Assets Money Market Fund is to maximize current income consistent with the preservation of capital and same-day. If you are a shareholder who is no longer permitted to own a. Retail money market fund, your holdings will be involuntarily redeemed by the fund or "Chase Bank. Clients with investment accounts serviced by a JP Morgan Advisor can earn a return on available cash balances by choosing to automatically sweep these balances. Define JPMorgan Chase Money Market Account. means an interest bearing account at JPMorgan Chase Bank, N.A. jpmorgan. @jpmorgan. K subscribers•K videos. J.P. Morgan is a leader in financial Surprises and a Look Ahead | Market Matters | J.P. Morgan. The investment seeks current income while seeking to maintain liquidity and a low volatility of principal. The fund invests in high quality, short-term money. Chase Bank refer a friend for checking accounts. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus. About. JPMorgan Prime Money Market Fund. 6 | J.P. MORGAN MONEY MARKET FUNDS. Page 9 (JPMorgan Chase), a bank holding company. JPMIM is located at Madison. The Fund will comply with SEC rules applicable to all money market funds, including Rule 2a-7 under the Investment Company Act of Portfolio Managers.

Get access to a line of credit backed by non-retirement, marketable securities such as stocks, bonds and mutual funds. Learn more. J.P. Morgan Funds are distributed by JPMorgan Distribution Services, Inc., which is an affiliate of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. 7-day yields are currently 3% for some money markets. Just can't seem to find one within chase that actually works (allows purchase). The investment seeks current income with liquidity and stability of principal. The fund invests in high quality, short-term money market instruments which are. The Fund seeks current income with liquidity and stability of principal. The Fund invests exclusively in high-quality, short-term money market instruments. Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Market Data. Advisory Accounts ; *******, The. J.P. Morgan Deposit Account, Agreement ; ABL4, JPM Tax Fee Money Market Fund Symbol JTFXX, Fact Sheet · Summary Prospectus. IM, JSMXX, JPMorgan % U.S. Treasury Securities Money Market Fund - IM ; Institutional, JTSXX, JPMorgan % U.S. Treasury Securities Money Mkt Fd - Inst Shr. All of the J.P. Morgan Funds may invest in affiliated and unaffiliated money market funds JPMorgan Chase & Co. Those businesses include, but are not. The J.P. Morgan money market funds (including the Fund in this prospectus) are intended for short-term investment horizons, and do not monitor for market timers. The fund invests in high quality, short-term money market instruments which are issued and payable in U.S. dollars. It will invest at least 25% of its total. Browse J.P. Morgan Money Market to find information on returns, expenses, dividend yield, fund managers and asset class allocations. Analyze the Fund JPMorgan Prime Money Market Fund Capital Class having Symbol CJPXX for type mutual-funds and perform research on other mutual funds. Discover a wide range of competitive money market rates and other savings options from Bankrate. Compare and open one today to maximize your savings. J.P. Morgan Global Liquidity China is the fund distribution business of JPMorgan Chase Bank (China) Company Limited. A pioneer of triple-A rated money market. Fund Stats ; NAV · $ ; Transaction NAV · $ ; Market Based NAV · ; Daily Liquid Assets · % ; Weekly Liquid Assets · %. The investment seeks current income while seeking to maintain liquidity and a low volatility of principal. The fund invests in high quality, short-term money. Choose from a wide range of stocks, ETFs, options, mutual funds, money market funds, treasuries & other fixed income. Powerful tools. From alerts to. Chase no longer offers a money market account. However, it does provide money market funds through online investing with J.P. Morgan. Chase also has checking. Record 31 J.P. Morgan Wealth Management Advisors Selected for Forbes' Top Next-Gen List · JPMorganChase to Expand Banking Services for Customers, Communities in.